Tag: Refinitiv

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

The Tenth Annual Trading Intentions Survey

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

Research: Analytics use in trading workflow increases by 72% over three...

Effectiveness for reporting and desk performance assessment improves year-on-year.

The DESK’s latest research into trading analytics has found its use growing within the trading workflow,...

Research: Trading Intentions Survey 2023

Major platforms show stable leadership in corporate bond trading

Some notable changes in results this year also reflect a change in demographics from respondents. This...

U.S. Credit Trading Q&A: Jim Kwiatkowski, LTX

Jim Kwiatkowski was named CEO of LTX, Broadridge Financial Solutions’ artificial intelligence (AI)-driven digital trading business, in November 2022. Markets Media caught up with Jim to learn more...

Ending technology asymmetry in primary markets for bonds

By Rahul Kambli, Senior Product Owner, Genesis Global.

Accessing the primary market for corporate bonds can be lucrative for asset managers astute about pricing and...

LSEG integrates CanDeal pricing into Canadian fixed income indexes

CanDeal Data & Analytics (CanDeal DNA), the provider of Canadian data and information services, has expanded its relationship with LSEG businesses, FTSE Russell and...

The implication of falling US HY Issuance

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from...

Research: Fixed Income TCA Survey 2022

Better integration into trading workflow

The DESK’s execution research survey into fixed income TCA 2022.

Our research took in 40 major asset management firms’ use...

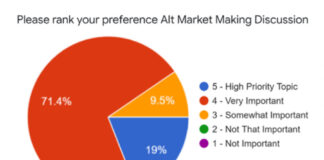

Credit Market Structure Alliance: The real market agenda

The CMSA, invitation-only event, is setting an agenda based on market professionals’ concerns, and has captured a groundswell of interest.

The DESK: What has been...