Tag: MTS

MTS launches dealer to client ticket protocol

MTS has introduced a new Dealer-to-Client Ticket (DCT) protocol on its BondVision platform, aiming to streamline trade workflows and reduce operational friction for both...

Dealers face crunch on platform trading costs

As bid-ask spreads tighten and fees rise, dealers question making markets in credit.

It does not take a quant to understand that tighter bid-ask spreads...

MTS boosts BondVision credit trading with dealer-driven growth initiative

Euronext’s MTS is building out its BondVision platform, aiming to grow the platform and promote competition across the market.

Introducing competitive and simple fees for...

Euronext launches government bond index family

Euronext, in partnership with its electronic fixed income trading platform MTS, has launched a European government bond (EGB) index family.

Derived from the “mother index”,...

Nick Sollom joins MTS

MTS, part of the Euronext Group, has appointed Nick Sollom as head of business development and strategy.

Sollom has more than 20 years of industry...

The Tenth Annual Trading Intentions Survey

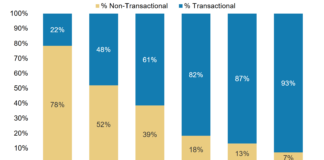

Key parts of bond market electronification are still up for contention, with stiff competition across pre-trade, primary and secondary market services.

In 2024 The DESK...

Industry viewpoint: A fully formed market from day one

Angelo Proni, CEO at Euronext Group’s MTS explains how electronic market making will increase transparency and liquidity of EU debt instruments and make them...

MTS: Building a better interest rate swaps market

Tom Harry, Head of Cash, Derivatives & Regulation Product Management at MTS

MTS has a strong track record of building robust interdealer and dealer-to-client franchises,...

MTS and Wematch.live launch risk netting service for interest rate swaps...

European electronic fixed income platform MTS and fintech Wematch.live have successfully trialled the first session of the risk netting Service for interest rate swaps...

Research: Trading Intentions Survey 2023

Major platforms show stable leadership in corporate bond trading

Some notable changes in results this year also reflect a change in demographics from respondents. This...