Tag: Morgan Stanley

Dealers had ‘exceptional’ 2022 for fixed income; JP Morgan tops Q1...

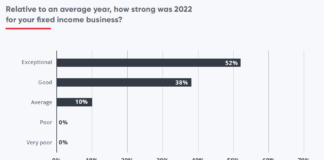

Research by front-office technology provider, valantic FSA, and analyst firm, Acuiti, has found that 52% of dealers had an ‘exceptional’ year for fixed income...

Analysis: E-trading platforms see gains and losses in corporate bond market...

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...

Absorbing Gilt

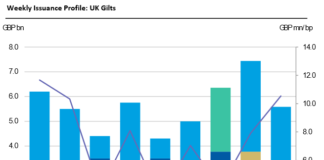

The year after next, the UK is set to issue £305 billion gilts to support the government’s spending programme. The high level of issuance...

Could the Twitter hangover really hurt credit liquidity?

Banks’ support for market making is tied to the bonds they carry on their books, and the cost that has for their balance sheets....

Barnes on Bonds: Primary Gilt Trip

To see political risk writ large in financial markets, look no further than the UK. While Rishi Sunak has won the race to be...

FILS 2022: How ‘Giltmageddon’ could hit LDI specialists and drive new...

Traders at the Fixed Income Leaders Summits (FILS) largely reported that bond markets were quiet this week, with high yield and emerging bond markets...

‘Whatsapp’ fines for banks hit US$1.8 billion

US market regulators have collectively fined 15 broker-dealers, one affiliated investment adviser, plus the swap dealer and futures commission merchant (FCM) affiliates of 11...

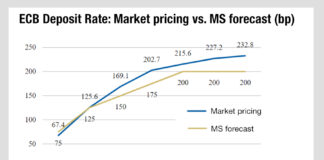

Chart of the week: ECB rates rise expectations

Expectations on the European Central Bank’s appetite to increase its interest rate will have a direct and negative impact on European bond trading which...

Research: Fixed Income TCA Survey 2022

Better integration into trading workflow

The DESK’s execution research survey into fixed income TCA 2022.

Our research took in 40 major asset management firms’ use...

MarketAxess: New trading protocols are expanding, not cannibalising, liquidity

MarketAxess has reported its second highest level of quarterly revenue and credit trading volume, as well as a record total trading volume in Q1...