Tag: Morgan Stanley

Scaling up EM Hard Currency trading with Targeted RFQ

In often illiquid and volatile emerging markets (EM), achieving best execution is a vital part of delivering on fund objectives. Increasingly, electronic trading plays...

The Book: JP Morgan rules the roost in Q1 DCM market...

JP Morgan has retained its top spot in global debt capital markets rankings by volume for Q1 2025, according to Dealogic.

With US$178.5 billion, 806...

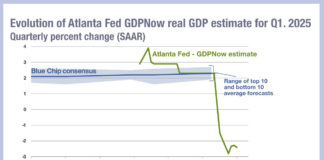

Implications of Atlanta Fed negative GDPNow score for US credit

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March,...

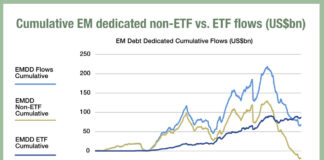

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

Long running CMA investigation concludes with 4 banks fined £100m

The Competition and Markets Authority (CMA) has completed its investigation into anti‐competitive information exchanges in the UK government bond market, no names or details...

The Book: Primary dealer positions climb rapidly, but concerns appear unfounded

Primary dealer positions of US Treasury holdings are expanding rapidly, but concern around restrictions on capacity are misplaced according to analysis.

A new paper by...

Bloomberg launches US Treasury dealer algos to expand buy-side access to...

Bloomberg announces the completion of the first trade using its newly launched US Treasury (UST) Dealer Algos.

This first-to-market solution provides buy-side clients with broader...

Credit hungry in 2025

The market is clearly very hungry for more credit, a positive signal given how much new and refinanced debt is being issued.

This can most...

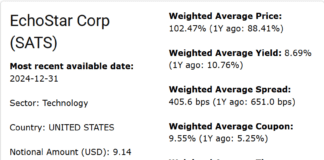

Origination: Issuer profile – EchoStar Corp

EchoStar Corp saw the largest proportional increase in notional debt outstanding in the technology sector in 2024, with a 509% increase, taking it to...

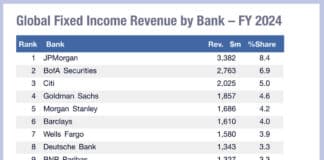

Competition for debt issuance fierce as activity remains

Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly...