Tag: MarketAxess

Review of 2023 Trading: Trade sizes falling – in parts…

Looking back at this year’s trading activity, through analysis of MarketAxess Trax data and TRACE for US markets, we can see clear patterns emerging...

Bloomberg, MarketAxess and Tradeweb axe joint consolidated tape project

Bloomberg, MarketAxess and Tradeweb today jointly announced they will not form an independent company to participate in the public procurement procedure to become the...

The beginning of the end (of liquidity provision)?

Bid ask spreads are widening in US investment grade credit, according to MarketAxess’s CP+ data, which may signal the traditional end-of-year withdrawal of dealer...

The right tools for trading: Tim Monahan, ICE

Tim Monahan, senior director of product management at ICE explains how ICE continues to develop services and products that better support traders in fixed...

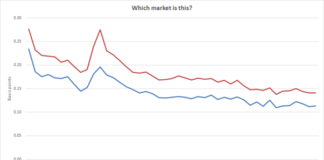

Can you guess which market has seen the greatest fall in...

Two weeks ago, we asked what was crushing the US investment grade (IG) market’s bid-ask spread. However there has been an even greater reduction...

E-trading fixed income volumes rose in October with risk assets facing...

Electronic trading platforms saw net growth in the fixed income space for October, although risk assets faced headwinds.

Tradeweb saw its total trading volume for...

What is crushing the bid-ask spread in US IG?

The bid-ask spread in US investment grade credit has been falling this year, regardless of the trading volume activity.

Notional traded in the US...

Trading: Loans and ABS: The fixed income markets time forgot

Trading in the less liquid parts of the fixed income market has remained relatively untouched by electronification.

Loans and securitised products backed by loans can...

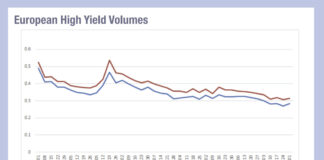

Bond market operators see high yield down in Q3 2023 YoY...

MarketAxess saw its US high-yield average daily volumes (ADV) for Q3 2023 drop 20.4% against Q3 2022, standing at US$1.3 billion, while high-grade ADV...

Europe sees big drops in implied liquidity costs

Since the start of 2023, European corporate bonds have seen a greater drop in bid-ask spreads than has been seen in their US investment...