Tag: MarketAxess

High Yield did not get the ‘trade size’ memo

High yield trade sizes are continuing to rise in 2024, and its bonds continue to show signs of increasingly manual trading. As bond markets...

John Maggiacomo joins MarketAxess as head of North America client sales

John Maggiacomo has been named head of client sales in North America at MarketAxess, based out of New York.

In the newly created role, Maggiacomo...

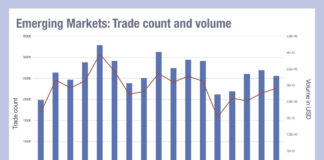

What EM trade sizes tell us about market evolution

While issuance of emerging markets bonds beat the same period in 2023 by a third, secondary trading is far more choppy, with a stepped...

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners, and benefits.

Three firms have confirmed they will compete to be...

E-trading: Tradeweb takes lead in US credit for April

Electronic trading platforms are reporting another month of double figure volume growth in fixed income markets, with Tradeweb overtaking MarketAxess in US investment grade...

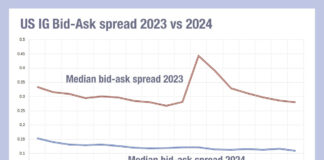

A great vintage for bid-ask spreads

This year’s bid-ask spreads in US investment grade are half those of last year, prompting much celebration on the buy side, but clearly having...

Dan Burke joins MarketAxess

MarketAxess Holdings has appointed Dan Burke as global head of emerging markets. He reports to Raj Paranandi, chief operating officer for EMEA and APAC....

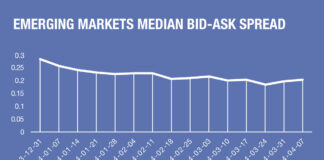

Bid-ask spreads drop 25% on average in many markets

The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year,...

Sunil Daswani rejoins MarketAxess

MarketAxess has confirmed the appointment of Sunil Daswani as senior sales relationship manager.

In the role, Daswani will lead business development efforts and deliver client...

MarketAxess industry viewpoint

Comparing portfolio trading and list RFQ TCA

By Gio Accurso, Grant Lowensohn and Jessica Hung, MarketAxess

Highlights and objectives

The MarketAxess Research team investigates any key...