Tag: MarketAxess

Portfolio Trading and price discovery in US IG and HY markets

By Jessica Hung and Chisom Amalunweze

In our PT vs RFQ List White Paper, we found that PT provides superior execution outcomes for illiquid bonds,...

What Mexico’s vol risk means for trading LatAm bonds

In Latin American (LatAm) markets, economic volatility may transfer into market volatility – most notably in Mexico.

In order to manage risk and seize opportunities...

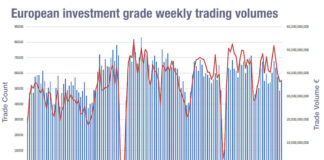

Summer heat subdues European activity

Activity in both European high yield (HY) and investment grade (IG) declined in the last week of July, with trade volumes falling to yearly...

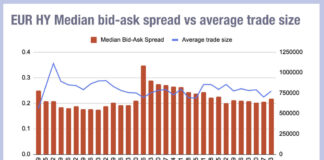

Trade size growth undercuts European bond market ‘equitification’

Since 2023 European corporate bond markets have seen trades size grow, as trading platforms report increasing volumes

“If we break down electronic trading growth in European...

US electronic platforms’ credit activity plateaued in July

Tradeweb now narrowly leads over MarketAxess in fully electronic US IG+HY trading, Trumid said it continues to gain market share.

Average daily volume reported on...

MarketAxess brings mid-point matching protocol to US credit

MarketAxess has launched its anonymous mid-point matching session protocol, Mid-X, in US credit.

Mid-X uses CP+, MarketAxess’s real-time predictive pricing engine for its global credit...

TransFICC: The Evolution of the Muni Market

Driven by volume growth and technology

By Bo-yun Liu, Director of Product Solutions, TransFICC

Taken in aggregate, the Muni market is roughly $4.2T Outstanding with $15.6B...

BlackRock and Standard Chartered make first India trade on MarketAxess

BlackRock and Standard Chartered have executed the first trade on MarketAxess’s Indian government bond (IGB) electronic trading solution.

MarketAxess became the first firm to offer...

European credit volumes plummet as US stays buoyant

European corporate bond markets have seen trading volumes and trade count collapse going into summer, as the holiday period provides some respite for tired...

Traders welcome India’s bond e-trading evolution as regulator shows teeth

The Indian bond market provides a conundrum for investment traders, who fight to gain access to liquidity and pricing information on behalf of their...