Tag: MarketAxess

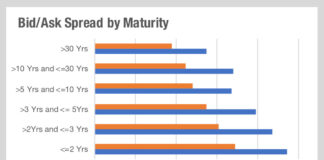

The impact of trading long-dated bonds

Faced with the prospect of climbing rates, some investors will be looking to switch out of lower coupon bonds to capture higher returns. However,...

MarketAxess EM extends coverage to Egypt, Hong Kong and Serbia

Bond market operator and data provider MarketAxess has added Egypt (EGP), Hong Kong (HKD) and Serbia (RSD) to its Emerging Markets (EM) local markets...

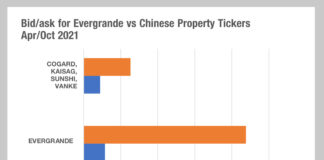

China Focus: The secondary effect of defaults

The bid-ask spread for bonds in China’ property market has expanded by 300% this year, although even more so for Evergrande which increased by...

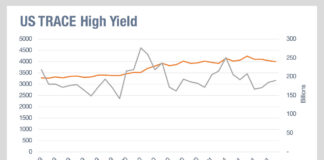

Prioritising investment on the high yield trading desk

When we look at the priorities of trading desks in developing more automated tools, we can consider the longer term market trends as a...

E-trading bond platforms outperform banks’ Q3 in fixed income trading

Market operator Tradeweb has seen a strong Q3 revenue against the same quarter in 2020, while electronic bond-trading MarketAxess has seen a slight decrease...

Craig McLeod: Exploring the new frontiers of EM trading

Today’s EM traders need more data, market access and broader liquidity than ever before to meet the investment profiles of their portfolios. Craig McLeod,...

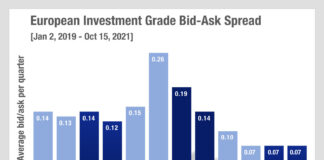

Seeing the pressure market makers are under in European credit

Secondary market data paints a picture of the challenges faced by sell-side market makers in the European corporate bond market during Q4. Information from...

FILS 2021: Boosting liquidity through market structure

The rise in bilateral streaming and the regulatory push towards central clearing can increase the diversity of trading counterparties and boost liquidity according to...

FILS 2021: Tapping into the ‘data revolution’

Data integration, the acceleration of electronification and the incorporation of environmental, social and governance factors in fixed income were highlighted as the big issues...

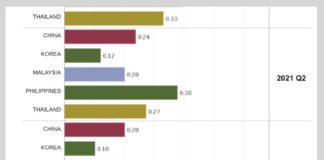

APAC trading recovery is far from even

The recovery from last year’s market sell-off and the ongoing Covid-19 pandemic appears to have been marked in many regions, with volumes for both...