Tag: MarketAxess

Bond CTP race heats up

Etrading Software launches a free-to-use in 2025 Consolidated Tape prototype, intensifying competition among prospective providers.

Etrading Software (ETS), a provider of technology-led trading software solutions...

Tradeweb takes electronic credit trading lead, for second time

Multi-asset market operator, Tradeweb, has recorded average daily volume (ADV) of US$8.6 billion in US credit during February, surpassing rivals MarketAxess (US$8.5 billion) and...

US markets seeing risk implied in bid-ask spread

While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to...

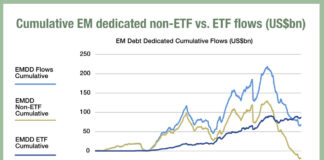

Inflows to EM debt beta funds could change trading patterns

Emerging market (EM) exchange traded funds (ETFs) have seen cumulative inflows of US$1.9 billion year to date, according to analysis by Morgan Stanley, while...

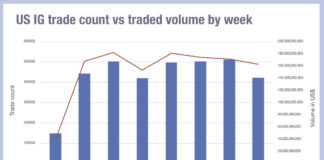

Picturing uncertainty in a traditionally stable market

Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major...

Raj Paranandi resigns from MarketAxess

European and APAC chief operating officer Raj Paranandi is leaving MarketAxess for an external role, the company has confirmed.

Paranandi has been in the role...

MarketAxess trading volumes dip in static corporates market

US corporate bond markets have had an unexciting start to the year, remaining flat at US$50 billion in average daily notional volumes (ADNV).

Market share...

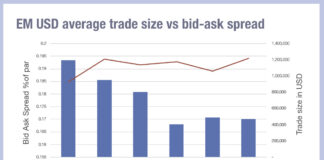

Emerging markets see liquidity costs decline

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing...

Strong start of the year in electronic credit trading

Electronic credit markets started 2025 on a strong note, with January's total credit average daily volume (ADV) showing robust growth across platforms. Trumid reported...

Bringing together fixed income trading and global youth empowerment: An emerging...

Founded in 2000 by finance professionals who saw the social inequities in the emerging markets where they invested, EMpower supports hundreds of initiatives that...