Tag: MarketAxess

FINBOURNE Technology named tech provider for Bloomberg, MarketAxess and Tradeweb consolidated...

FINBOURNE Technology recently participated in a tender process, against a number of industry peers, including Ediphy - however not Propellant.digital as previously identified -...

Technology: Educating data

Can better pre-trade data really unlock liquidity in frozen fixed income markets?

If buy and sell-side bond traders are to see real benefits from the...

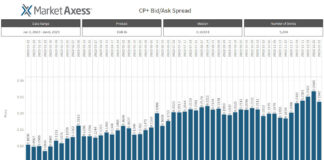

US Credit: Liquidity costs trending down

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading...

Concannon to take the reins at MarketAxess

Market operator, MarketAxess, will see current CEO and chairman Rick McVey become executive chairman from 3 April 2023 as Chris Concannon, currently president and...

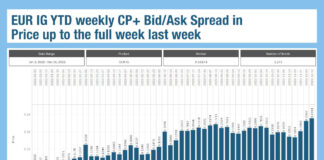

Same trading costs, different year

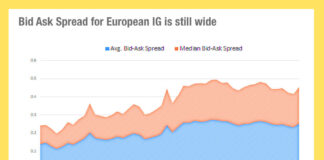

The new year has seen trading volumes drop back to a similar level as seen in early January 2022, but in European credit, bid-ask...

Tradeweb and MarketAxess see credit volumes increase over 25% in December

Market operators MarketAxess and Tradeweb have released their December trading levels, with both seeing a monthly increase of 25% in credit trading average daily...

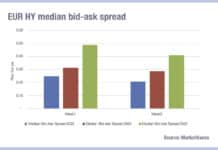

Reviewing 2022: European credit trading costs have doubled

There have been an enormous number of factors shaking up bond trading this year. From fixed income fundamentals like rapidly rising interest rates from...

Analysis: E-trading platforms see gains and losses in corporate bond market...

Morgan Stanley analysis of the monthly reports from market operators Tradeweb and MarketAxess, has shown wins and losses in market share for both platforms.

Looking...

All I want for Christmas, is trading analytics

Traders would do well to run close analysis over their European trading activity this month, as data from MarketAxess Trax, which tracks trading across...

Illiquidity creeps up in US credit… will e-trading save the day?

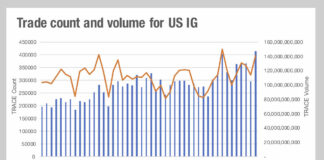

Looking at data on US credit markets, taken from MarketAxess Trax, which tracks trading across multiple markets and counterparties, investment grade trading volumes have been...