Tag: MarketAxess

Review: An apples-to-apples comparison of all-to-all trading platforms

We compare the very different all-to-all offerings provided by electronic trading platforms.

A good all-to-all offering can really support electronic liquidity provision, especially if traditional...

Research: Analytics use in trading workflow increases by 72% over three...

Effectiveness for reporting and desk performance assessment improves year-on-year.

The DESK’s latest research into trading analytics has found its use growing within the trading workflow,...

EM stabilising could encourage market makers

Emerging market activity has seen a reduction in volatility in the first half of the year, with both volumes and pricing levels falling slightly,...

Market gives cautious response to Sweden’s ‘detail-lite’ MiFID II deal

The Swedish presidency of the Council of the European Union (Council) reached a last-minute agreement with the EU Parliament on proposed changes to the...

Viewpoint: Measuring the performance of automated execution in volatile markets

The success of automated trading in bond markets is both persistent and consistent, says Andrew Cameron, director of trade automation at MarketAxess.

Automation technologies are...

EXCLUSIVE: Citadel Securities confirms plans to enter corporate bond market

Citadel Securities has announced plans to enter the corporate bond market this year, The DESK can reveal, in a surprise play for one of...

FILS USA 2023: Finding efficiency in fixed income trading

Market operators seek to expand reach of surprisingly resilient automation.

Fixed income trading has become much more efficient over the years, driven by new technologies...

FILS USA 2023: Macro effect on trading; BlackRock says higher rates...

The macro environment is having a major effect on the attractiveness of certain instruments, noted Sonali Pier, managing director and portfolio manager at PIMCO,...

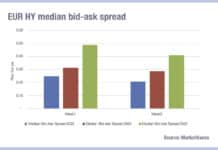

Liquidity costs ticking up as the heat rises

Summer is seeing the cost of trading in fixed income markets begin to tick up again, as bid ask spreads begin to widen, according...

MarketAxess muni offerings incorporated into Investortools Dealer Network

Fixed-income electronic trading platform MarketAxess has expanded its municipal bond integration with the Investortools’ platform, the latest phase of its Financial Information eXchange (FIX)...