Tag: MarketAxess

Trading Intentions Survey 2025

The battle for pre-trade analytics

The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US...

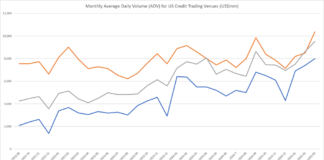

Surge of activity on fixed income trading platforms

MarketAxess has regained the lead in US credit fully electronic trading amid a surge of activity in March with Trace printing a record US$61.2...

Pre-Trade data strategy: Optimizing protocol selection in European Credit

By Chris Egan & Aria Pattinson-Spiers: A decision that clients often face is which trading route to take—a high touch or low touch approach....

US HY volumes hit yearly highs post-Liberation Day

US high yield (HY) trading volumes hit yearly highs last week as the country comes to terms with the implications of Trump’s ‘Liberation Day’...

Scaling up EM Hard Currency trading with Targeted RFQ

In often illiquid and volatile emerging markets (EM), achieving best execution is a vital part of delivering on fund objectives. Increasingly, electronic trading plays...

Trade munis like a champion.

To kickoff Muni Madness, MarketAxess are unveiling their latest White Paper that details the methodology behind this revolutionary pricing tool that brings transparency to...

Trumid upgrades US corporate bond predictive pricing tool

Trumid launches its enhanced Fair Value Model Price (FVMP) tool, which aims to deliver predictive pricing for around 22,000 US corporate bonds every 30...

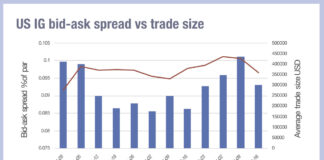

Is rising credit risk displaying in bid-ask spreads?

US credit markets are seeing a divergence in bid-ask spreads and trade sizes between high yield and investment grade bonds, according to data from...

E-trading stumbles in US credit

E-trading in high yield (HY) US credit reduced year-on-year (YoY) in February, despite rising average daily trade sizes.

After taking almost a third of traded...

Bond CTP race heats up

Etrading Software launches a free-to-use in 2025 Consolidated Tape prototype, intensifying competition among prospective providers.

Etrading Software (ETS), a provider of technology-led trading software solutions...