Tag: Kevin McPartland

US corporate bond market growth continues upward trend in July

The US corporate bond market in July saw increases across nearly all the metrics tracked by Coalition Greenwich, with average daily notional volume (ADNV)...

Voice trading remains prevalent in Treasury trading

Citadel Securities is conducting a third of its Treasury risk by voice, according to a representative. Kevin McPartland, head of research, market structure and...

‘Today’s inefficient is yesterday’s efficient’: Innovation in corporate bond issuance

While nearly half (47%) of corporate bond investors feel that technology has made the new issue process more efficient, the mechanics of distributing newly...

US primary dealer bond trading hits record low

US Treasury market volatility saw a decline in March, according to Coalition Greenwich’s April Data Spotlight on US rates trading. The MOVE Index monthly...

Leveraged loan market ripe for innovation after 2023 revenue bump

US dealer revenue hit US$900 million in 2023, representing a 16% increase against 2021 and a 29% bump on 2022, attributed to a renewed...

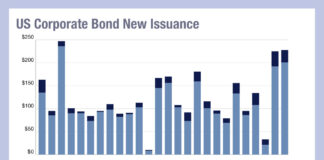

Issuing at the top of the market

The high levels of bond issuance this year, made at what is widely expected to be peak interest rates, are potentially building up high...

Coalition Greenwich: US Treasury e-trading volumes hit record in February

US Treasury volumes saw an average daily notional value (ADNV) of US$918 billion in February 2024, Coalition Greenwich’s March Data Spotlight has reported, up...

Coalition Greenwich: US Treasuries trading up 46% YoY in January

“The more the US government borrows (US$2.6 trillion in January), the more US Treasury traders trade.”

This activity, according to Coalition Greenwich’s Kevin McPartland, is...

Credit: January sees largest average daily notional for US corporate bonds

January 2024 saw the largest single volume day and largest average daily notional volume (ADNV) month ever for US corporate bonds.

$75 billion of investment...

Improved auto-quoting tops wishlist for corporate bond investors

Improved auto-quoting tops the list of what corporate bond investors would like to see more of from their liquidity providers. That is according to...