Tag: ICE

ICE chases Tradeweb in MBS electronic trading

ICE aims to get a bigger pie of the electronic Mortgage Backed Securities (MBS) trading market and introduces a new anonymous Request-for-Quote (RFQ) protocol.

Intercontinental...

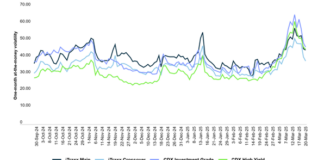

US credit jitters do not spill over to Europe, ICE data...

In an environment of rapid market shifts and mounting uncertainty, recent ICE data reveals that while volatility in U.S. credit markets has surged, European...

ICE taps CanDeal for intraday pricing

ICE has partnered with CanDeal to provide intraday price updates and bond analytics data for the Canadian fixed income market.

Intraday and end-of-day reference prices...

ICE: Indexing – the next evolution

ICE offers advancements with customisation, AI and a depth of historical data

The DESK spoke to Varun Pawar, ICE Fixed Income & Data Services’ Chief...

ICE: Measuring and managing climate risk in debt markets

As the physical risks associated with climate rapidly shift, borrowers, lenders and investors need to better understand their exposure. Larry Lawrence, head of sustainable...

ICE: Creating clarity in the MBS market through better data

The highly fragmented nature of mortgage asset components has historically translated into a lack of granular data for investors. Intercontinental Exchange (ICE) aims to...

ICE: Continuous Evaluated Pricing™ (CEP™)

As bond markets are transformed by electronic trading, ICE is helping bring real-time insight to a complex asset class. Senior Director, Bond Pricing Product...

ICE: Size-Adjusted Pricing (SAP)

Shifting odd lot dynamics throw a spotlight on ICE’s Size-Adjusted Pricing

A dramatic jump in small trade volumes, driven by increased retail and electronic...

Global Data Happens at ICE

Across global markets, data underpins every decision. At ICE, we provide quality data and analytics across global asset classes and at every stage of...

ICE: Municipal bonds – reliable pricing for a fragmented market

ICE’s rules-based, transaction-driven approach provides a transparent representation of municipal market movement.

By Patrick Smith, Senior Director, Head of Municipal Evaluations, ICE

The complex and fragmented...