Tag: FINRA

US credit trading reached record highs pre-tariffs

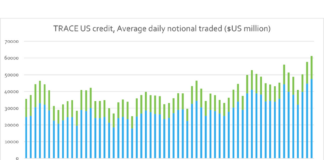

The corporate bond market was already at record levels before the US tariffs came into force, FINRA data shows.

US credit trading volumes reached record...

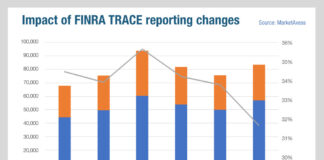

What FINRA’s trade reporting changes tell us about consolidated tapes

Understanding the difference between commercial and public data offerings is crucial for data users. A good example of this difference can be found with...

New flexible data offerings – Eugene Grinberg

Eugene Grinberg, Solve Advisors Co-Founder and CEO, tells The DESK how the firm’s acquisition of Advantage Data and Best Credit Data will support better decision-making...

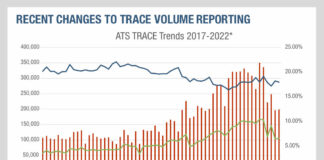

TRACE recalibration exposes double counting

An adjustment to bond trade reporting to TRACE, the US post-trade reporting tape for fixed income, has cut the volume of trades arranged via...

MeTheMoneyShow – Episode 22

Dan Barnes speaks with Lynn Strongin Dodds about some old chestnuts - a consolidated tape for European equities, and the implications of Brexit for...

Fixed Income Leaders : The DESK

Fixed Income Leaders – Expectations for 2018

The DESK spoke with members of the advisory panel for FILS Amsterdam to assess the likely agenda.

In November 2018,...

SEC committee proposes TRACE block trading delay

The Securities and Exchange Commission (SEC) Fixed Income Market Structure Advisory committee met on 9 April 2018 to discuss a proposed pilot for a...

US Treasury recommends HFT firms be identified in TRACE data

By The DESK.

In a review of market structure issued on 6 October 2017, the US Treasury has recommended closing the gap in the granularity...

Treasuries reform and the buy-side trading desk

Growing automation and market relationships will mean regulatory change is only part of the story. Dan Barnes investigates.

Plans to make the US$543 billion-a-day US...