Tag: Federal Reserve Bank of New York

Central Banks should backstop hedge funds arbitraging the basis trade, new...

A research paper to be presented at the Brookings Papers on Economic Activity (BPEA) conference on 28 March, argues that central banks, particularly the...

SMBC Nikko, first addition to the primary dealer list since 2022

On 3 February 2025, SMBC Nikko Securities America, Inc. (SMBC Nikko America), a registered broker-dealer and direct subsidiary of SMBC Americas Holdings, Inc., was...

Michelle Neal leaves New York Fed for private sector

Michelle Neal is leaving the Federal Reserve Bank of New York, effective March 2025, for payment systems developer Fnality.

Neal has been an executive vice...

FILS USA: Has US Treasury clearing mandate killed all-to-all trading for...

While there are still questions around the effect of US Treasury reforms on market structure, many buy-side traders will be focused on the impact...

JP Morgan restricted from onboarding new venues and fined US$350 million

JP Morgan has been fined US$350 million and may not onboard new trading venues without receiving prior written non-objection from the Federal Reserve Bank...

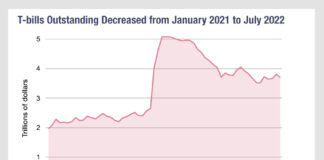

Treasury bill supply and ON RRP investment

By Gara Afonso, Marco Cipriani, Catherine Huang, Gabriele La Spada, and Sergio Olivas.

Take-up at the Federal Reserve’s Overnight Reverse Repo Facility (ON RRP) increased...

US Treasuries lost its ‘sell-side’; can clearing and capital rules revive...

Market participants report the current proposals by the US Securities and Exchange Commission (SEC) to centrally clear trades in the US Treasuries market are...

Michelle Neal: On taking great responsibility

Having managed the market divisions at several top-tier financial institutions, Michelle Neal is now responsible for supporting the most significant fixed income market in...

New York Fed economists see US Treasury liquidity at crisis levels

Current US Treasury market liquidity is comparable with the 2007-09 global financial crisis and the March 2020 crisis, particularly for the two-year note, according...

The $21.6 trillion question: How many regulators does it take to...

The US$21.6 trillion US Treasury market is confounded by a lack of transparency and very short-term liquidity provision, according to a new joint staff...