Tag: Federal Reserve

Central Banks should backstop hedge funds arbitraging the basis trade, new...

A research paper to be presented at the Brookings Papers on Economic Activity (BPEA) conference on 28 March, argues that central banks, particularly the...

Rules and Ratings: Fannie Mae and Freddie Mac – Is the...

On the last trading day of 2024, shares of Fannie Mae and Freddie Mac surged between 20% and 30% as 2024 ended, catalysed by...

The Federal Reserve faces legal challenge over stress tests and their...

As an early Christmas present, major banking and business associations filed a lawsuit on the 24th of December against the Federal Reserve System's Board...

Tom Porcelli named PGIM Fixed Income chief US economist

PGIM Fixed Income, a firm With US$793 billion in assets under management (AUM), has named Tom Porcelli chief US economist, effective 6 July 2023....

Unlocking Liquidity for the U.S. Treasury Markets

Unlocking Liquidity for the U.S. Treasury Markets

By MarketAxess | 22 November 2022

Advocating for all-to-all trading has always been the MarketAxess way, but lately, it...

ICMA recommends ECB follows Federal Reserve and SNB policies

The International Capital Markets Association (ICMA) has written to the European Central Bank (ECB) with a “concern that rising dysfunction in the market...

The $21.6 trillion question: How many regulators does it take to...

The US$21.6 trillion US Treasury market is confounded by a lack of transparency and very short-term liquidity provision, according to a new joint staff...

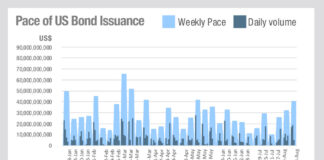

Is issuance for the high jump?

Data from CreditSights indicates the pace of US investment grade bond issuance fell from May, only to jump back in August, at a point...

Citi and JP Morgan absent from Fed programme

The list of eligible dealers for the Fed’s bond and exchange-traded fund programme for the 12th May has been published and it is missing...

FIMSAC: MiFID II shows flaws in ‘equitisation’ of bond markets

By Shobha Prabhu-Naik.

Europe’s revamped Markets in Financial Instruments Directive (MiFID II) legislation MiFID II carries ideas from the equity markets into other markets but...