Tag: European Commission (EC)

Origination: Zeitenwende – German issuance to grow 40%

The new CDU/CSU coalition pivot from “Schwartze Null” -Zero Black- to “whatever it takes for our defence” is shaking European debt markets.

Following the CDU/CSU...

UK government debt issuance soars

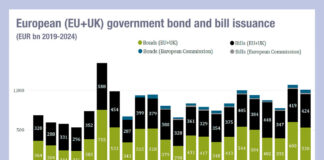

The latest report from the Association for Financial Markets in Europe (AFME), looking at European government bond markets, found that €1 trillion of bonds...

EU Commission joins Eurex as venue for repos

The EU Commission (EC) has joined Eurex as a venue for transactions in repurchase agreements.

The EC is the latest member to join the Eurex...

Hahn vows to continue drive for EU bond sovereign status

Johannes Hahn, commissioner responsible for budget and administration at the European Commission (EC) has said the organisation intends to continue its push for bonds...

Negotiations begin on MiFIR/MiFID final review and consolidated tape

EU member states’ representatives have today agreed a mandate for negotiations with the European Parliament on the proposed regulation reviewing the Markets in Financial Instruments...

FILS 2022: Deferral times priority for consolidated tape plans – EC’s...

Plans for a consolidated tape for fixed income markets in Europe hinge on the “urgent priority” of harmonising post-trade publication windows – keeping them...

MiFID II Review: EC could allow payment for order flow in...

An ongoing review of the revised Markets in Financial Instruments Directive (MiFID II) and Markets in Financial Instruments Regulation (MiFIR) has seen debate on...

Market reflects grim situation in Ukraine

The invasion of Ukraine on 24 February 2022 by Russia, wedded to subsequent sanctions and travel restrictions have triggered a series of market responses...

TransFICC launches fixed income consolidated tape pilot

TransFICC, the specialist provider of low-latency connectivity and workflow services for Fixed Income and Derivatives Markets, has launched a new initiative to develop a...

Ferber says ESMA ‘too powerful’ in new EC consolidated tape plan

The European Commission has today adopted a package of measures designed to improve the ability of companies to raise capital across the European Union...