Tag: ESMA

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners and benefits.

Three firms have confirmed they will compete to be...

Viewpoint: Knowing the boundaries

Interview with Tim Whipman, head of business development at TransFICC

In February this year ESMA published its Opinion on the Trading Venue Perimeter, which provides...

Will the EC ban electronic bilateral bond trading?

The broadening definition of ‘multilateral’ is at risk of capturing all trading if traders do not speak out.

The European Securities and Markets Authority (ESMA)...

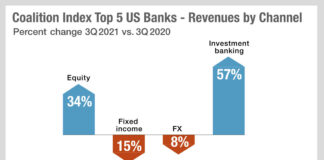

What banks’ primary success can tell us about their priorities in...

When looking at the revenues of investment banks in Q3 2021, using Greenwich Coalition data, we can see that secondary market trading in fixed...

ESMA moves to tighten up algo surveillance

Algo trading has grown increasingly complex over the last decade. In 2007, the Markets in Financial Instruments Directive (MiFID) permitted competition with the national...

Risk – Redemption shock

If funds are not given daily liquidity by the market, can they support daily redemptions for clients? Chris Hall reports.

When pandemic-fuelled panic hit the...

ESMA: Hundreds of bond funds suspended redemptions in record-breaking March sell-off

A new report by the European Securities and Markets Authority has laid out how systemic risk might be created through funds’ inability to process...

ESMA confirms data headaches for non-equity instruments

Trading venues and approved publication arrangements (APAs) – or post-trade data aggregators – are not always complying with the requirement to make available data...

Fixed Income Leaders : The DESK

Fixed Income Leaders – Expectations for 2018

The DESK spoke with members of the advisory panel for FILS Amsterdam to assess the likely agenda.

In November 2018,...

EC: ESMA should run consolidated tape for fixed income

By Flora McFarlane.

An expert group organised by the European Commission to analyse the European corporate bond market has issued recommendations aiming to make issuance...