Tag: Directbooks

NatWest, Loop Capital, and TD Securities join DirectBooks

NatWest, Loop Capital and TD Securities have joined the DirectBooks bond issuance platform. The recent additions increase the total number of underwriters on DirectBooks...

Exclusive: US Bank, KeyBanc Capital Markets and Fifth Third Securities join...

US Bank, KeyBanc Capital Markets, and Fifth Third Securities have joined the DirectBooks platform, increasing the total to 22 global underwriters on DirectBooks.

Jimmy Whang,...

The Trading Intentions Survey 2022

New platforms and late bloomers are all seeing greater interest.

This year buy-side desks have a renewed vigour for investing in trading tools, with far...

Société Générale, HSBC and MUFG join DirectBooks; US$1.6 trillion processed in...

Société Générale, HSBC, and Mitsubishi UFJ Financial Group (MUFG), have joined the DirectBooks platform bringing the total to 19 global underwriters live on DirectBooks.

In...

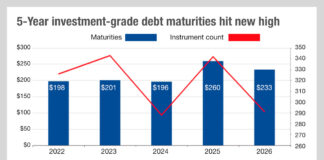

Trouble ahead for traders as number of issued bonds climbs

According to data from Moody’s Investor Services, the US investment-grade companies should have few problems refunding their debt in 2022, which is useful given...

FILS 2021: The five big questions at FILS this year

1. When will we see a functional consolidated tape?

Market structural discussions at FILS will naturally take in European Commission’s plans for the proposed consolidated...

Yieldbroker partners with IHS Markit to support Australian bond issuance

Data, analytics and trading solutions provider IHS Markit is collaborating with Yieldbroker, the electronic trading platform for Australian and New Zealand debt securities and...

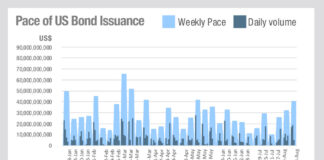

Is issuance for the high jump?

Data from CreditSights indicates the pace of US investment grade bond issuance fell from May, only to jump back in August, at a point...

Scotiabank, Rabo Securities and Huntington Capital Markets join DirectBooks

DirectBooks, the capital markets consortium founded to optimise the bond issuance process has signed up Scotiabank, Rabo Securities and Huntington Capital Markets to join...

Primary markets : Discretion is the better part of bond issuance

The US regulator has raised questions over bank control of new issuance automation – the question is whether banks behave with valour.

A recent report...