Tag: Dealogic

September takes the biscuit in new issues

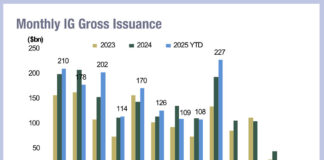

September did not disappoint in its delivery of high issuance in the US for corporate bonds across both investment grade and high yield. Monthly...

Mizuho’s DCM revenues break into global top ten

Global debt capital markets (DCM) revenues remained almost identical year-on-year (YoY) for the first nine months of 2025, with Mizuho the only new entrant....

September explodes with new corporate bonds

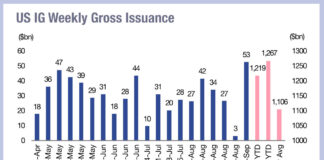

Traders report expectations of outsized corporate bond issuance, with up to US$60 billion expected in US investment grade issuance, and reached $53 billion last...

The Book: Equity-linked note issuance on the rise in APAC

Convertible and exchangeable bond issuance in APAC is on track for a record-breaking year, Citi has noted.

Convertible bonds allow holders to convert their bond...

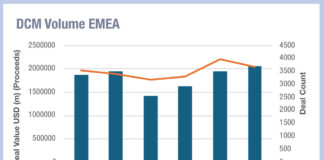

European debt is standing up for primary markets

Global debt capital market (DCM) deal count year-to-date is down 5% year on year, according to Dealogic data. However, the local market pictures present...

American primary debt markets keep humming

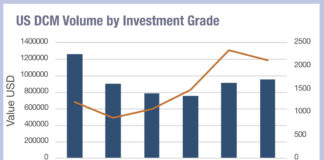

Dealogic data show US debt capital market (DCM) issuance is little changed year on year (YoY) in aggregate: 2025 year-to-date (YtD) totals US$1.97 trillion...

US bond deals fragment as EMEA consolidates

The latest breakdown of debt capital market (DCM) issuance by Dealogic has found that deal numbers in the US have declined slightly year-to-date versus...

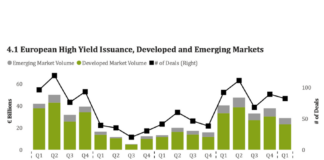

Insights & Analysis: European high-yield issuance dropped in Q1

Primary high yield (HY) bond issuance fell by 23.6% quarter-on-quarter (QoQ) in the first three months of the year, and was down almost 30%...

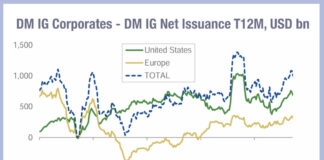

Primary held in check by tariff and rate uncertainty

Gross credit issuance has fallen in developed markets, according to data from Dealogic and Morgan Stanley, across investment grade (IG) and high yield (HY).

DM...

The Book: Global DCM deal values drop year-on-year

Global debt capital markets (DCM) deal values have dropped year-on-year over 2025 so far, falling below the five-year average, according to Dealogic data.

The US$3.1...