Tag: Coalition Greenwich

Market Structure: New risk and liquidity in the US Treasury market

Significant changes in counterparties and market structure have transformed US Treasury market activity.

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst...

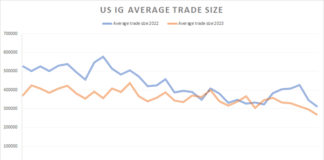

Are average trade sizes really falling in the US?

Earlier this year we noted that average trade sizes were down considerably on 2022, but being wary of mean reversion, we wanted to revisit...

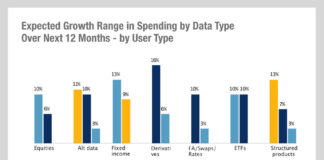

Coalition Greenwich: Buy-side data spend sees highest growth in fixed income

Spending is up across all categories of market data, with equities, fixed income and derivatives all expected to see a rise of more than...

Analysis: Market response to US Treasury’s increased borrowing needs

The US Treasury’s need to increase debt issuance, beyond market expectations, has had several effects. Firstly there was a ratings downgrade of the USA...

Local currency emerging market trading grows at MarketAxess

MarketAxess, the operator of an electronic trading platform for fixed-income securities, has seen a rise in volumes of local currency bond trading in emerging...

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

Regulation: innovation sees European corporate bond market’s electronification outpace US

When it comes to electronic trading, Europe’s corporate bond market is racing ahead of its US counterpart, with two thirds of European investors looking...

FILS US 2023: Technology tipping point was years ago, says BlackRock...

Stefano Pasquali, head of liquidity and trading research at BlackRock, told Coalition Greenwich’s Bob Fink that when it comes to technology, the focus now...

Worsening credit conditions battle improving trading capabilities

Both defaults and rerating of bonds are more likely in a high rate environment, and for trading desks this means finding efficient ways to...

Coalition Greenwich sees US bond trading volumes falling in Q2

A report by market analysis form Coalition Greenwich, part of S&P Global, has found that after an active first quarter, corporate bond trading slowed...