Tag: Coalition Greenwich

‘Tis better to give than to receive? How ELPs affect credit...

In a Christmassy spirited theme, The DESK considers how the advantages of electronic liquidity provision can support credit markets – and how the reception...

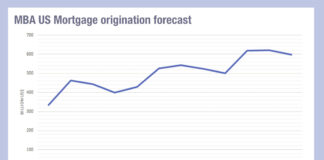

Betting the house

Mortgage origination in the US is predicted by the Mortgage Bankers Association (MBA) to rise significantly across 2024-25, yet trading of securitised mortgages still...

Coalition Greenwich: Opportunity to electronify block bond trades is huge

Analyst firm, Coalition Greenwich, has found that block trades in the US bond market, defined as trades in investment grade (IG) with a notional...

The beginning of the end (of liquidity provision)?

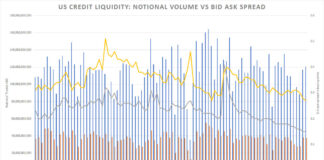

Bid ask spreads are widening in US investment grade credit, according to MarketAxess’s CP+ data, which may signal the traditional end-of-year withdrawal of dealer...

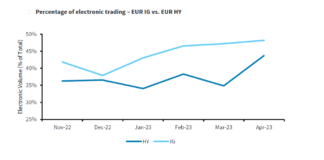

What does flat e-trading growth mean for credit traders?

The proportion of electronic trading in 2023 within US credit markets is proving stubbornly resistant to growth. Research by market structure analysts, Coalition Greenwich,...

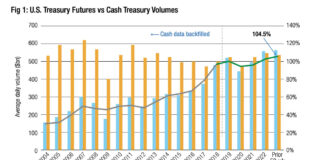

US Treasuries lost its ‘sell-side’; can clearing and capital rules revive...

Market participants report the current proposals by the US Securities and Exchange Commission (SEC) to centrally clear trades in the US Treasuries market are...

Trading: Loans and ABS: The fixed income markets time forgot

Trading in the less liquid parts of the fixed income market has remained relatively untouched by electronification.

Loans and securitised products backed by loans can...

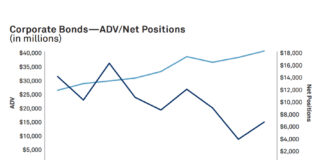

BOB Secondary: US Credit has never had it so good

Liquidity in US credit has improved significantly over the past year, with bid-ask spreads lower than any point in 2022, according to MarketAxess’s CP+...

FILS in Barcelona: If the future is futures, what happens when...

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson...

Hold me now!

“Hold me now,

Whoa, warm my heart,

Stay with me!”

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their...