Tag: Coalition Greenwich

Electric dreams in global rates markets

Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of...

US rates activity explodes post-tariffs

Tariff tumult in the US Treasuries market saw average daily notional volume spike over March, up 31% year-on-year (YoY) to US$1.089 trillion at the...

US credit trading reached record highs pre-tariffs

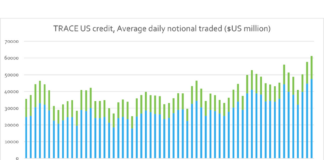

The corporate bond market was already at record levels before the US tariffs came into force, FINRA data shows.

US credit trading volumes reached record...

E-trading stumbles in US credit

E-trading in high yield (HY) US credit reduced year-on-year (YoY) in February, despite rising average daily trade sizes.

After taking almost a third of traded...

Voice volumes not budging in US Treasuries

E-trading levels are remaining steady in the US Treasury market, hovering at 58% of notional volume in February.

Ratios have returned to pre-election levels, Coalition...

MarketAxess trading volumes dip in static corporates market

US corporate bond markets have had an unexciting start to the year, remaining flat at US$50 billion in average daily notional volumes (ADNV).

Market share...

Manual trading remains popular in US rates market

Record issuance and higher holdings prompted significant US rates volume growth in January. While electronic trading maintained its market share, manual processes remain popular...

Strong start of the year in electronic credit trading

Electronic credit markets started 2025 on a strong note, with January's total credit average daily volume (ADV) showing robust growth across platforms. Trumid reported...

Coalition Greenwich predicts electronic revolution for the MBS market

A new study by Coalition Greenwich analyst Audrey Costabile posits that Mortgage Backed Securities trading will electronify over the next five years. Along with...

E-trading static but competition rises in US rates

Although US rates trading volumes were up 20% year-on-year, the proportion of that volume e-traded remained static. “We don’t expect this metric to move...