Tag: Association for Financial Markets in Europe (AFME)

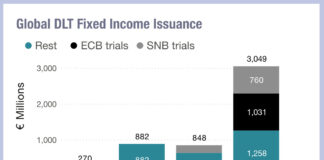

Measuring digital bond issuance

The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information...

Rules and Ratings: EU associations call for credit rating-led bond transparency

AFME, the German Investment Funds Association (BVI), Bundesverband der Wertpapierfirmen (bwf), EFAMA and ICMA have encouraged the EU to calibrate corporate bond transparency regimes...

“A vital first step”; FCA transparency regime sees industry approval

The International Capital Markets Association (ICMA) and Association for Financial Markets in Europe (AFME) have issued their full support for the FCA’s new transparency...

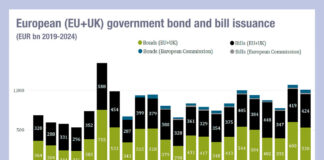

UK government debt issuance soars

The latest report from the Association for Financial Markets in Europe (AFME), looking at European government bond markets, found that €1 trillion of bonds...

Consolidated tape is welcome, but MiFIR still needs tweaks

The inclusion of a consolidated bond tape in the MiFIR review is welcomed, the International Capital Market Association (ICMA) says, but refinements need to...

Bank of England to embrace repo for liquidity management

Moving away from crisis-driven monetary actions, the Bank of England plans to manage liquidity through repurchase agreement (repo) practices rather than by purchasing large...

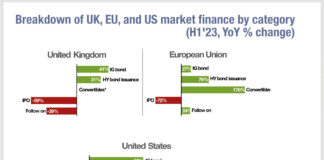

Issuance of debt increasingly financing UK companies

Analysis of corporate financing across European, UK and US markets by the Association of Financial Markets in Europe (AFME) has found that over the...

High yield bond issuance relative to liquidity

A report by the Association for Financial Markets in Europe (AFME) has found that primary issuance of European high yield (HY) bonds in 2023...

European HY bond issuance saw 45% increase in 2023

High yield bond issuance reached €66 billion in 2023, up from €45 billion in 2022 which had been a record low.

The findings come...

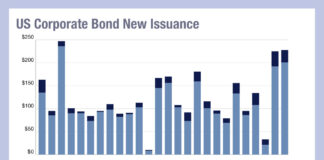

Issuing at the top of the market

The high levels of bond issuance this year, made at what is widely expected to be peak interest rates, are potentially building up high...