The 5th Annual Trading Intentions Survey sees a hunger for data and a surge in new liquidity tools.

• Massive growth for crossing / mid-point price tools

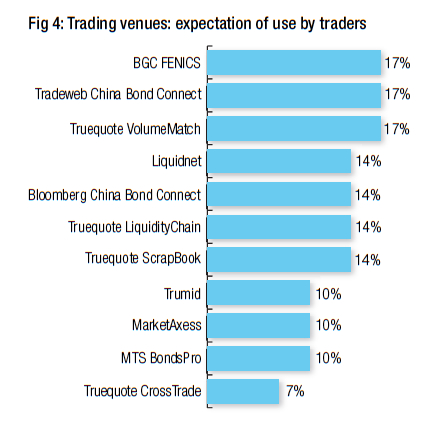

• Engagement with China Bond Connect platforms is high

• Big venues seeing a drop-off in traders classified as ‘Major Users’ vs 2018

• Value in O/EMS platforms still low when finding liquidity in fixed income

• Growing expectation that banks could facilitate greater liquidity in the market

Trading Intensions Survey methodology

• The DESK Trading Intentions Survey asks five questions, building a picture of which tools, platforms and services buy-side traders use today, and plan to use in the future.

• In 2019, 29 heads of trading / senior buy-side traders gave us their insights. Of those respondents, 72% had responsibility for US corporate trading, 86% for European trading and 72% for emerging markets trading.

• Traders use many tools to find liquidity including pre-trade data & analytics tools, trading venues, and execution / order management systems (E/OMSs).

• Responses reflect the proportion of respondents that use tools not volume of activity.

• We do not include results of 5% or less on charts as it creates a long tail. There are many additional platforms that have statistically small use bases amongst our respondents.

Appetite for new ways to source liquidity and pricing for corporate bonds has returned after the lull of 2018, which saw a concentration of activity on the major platforms.

Last year in Europe, traders had focused on a few platforms as the new Markets in Financial Instruments Directive (MiFID II) regime bedded down. Processing voice trades on platforms has increased their use, albeit to support reporting obligations. The absence of a single post-trade tape of price data, such as the US has with the Trade Reporting and Compliance Engine (TRACE), means that pre-trade data tools such as Algomi and B2Scan are more popular with firms that have European operations, while asset managers that have US operations are more inclined towards proprietary pre-trade data tools.

In the US, an ongoing consolidation of venues and platforms has reduced choice of where to trade; in 2017 trading venue Trumid bought rival Electronifie, ITG shut down POSIT FI, and ICE bought Bondpoint from KCG, a platform it will combine with TMC Bonds and ICE Credit Trade in 2019 under a single entity.

The winners: Trading venues

• Most used to find liquidity: MarketAxess

• Greatest ‘major use’ to find liquidity: MarketAxess

• Greatest growth: TrueQuote CrossTrade

• Greatest engagement for future: BGC FENICS / Tradeweb China Bond Connect / TrueQuote VolumeMatch

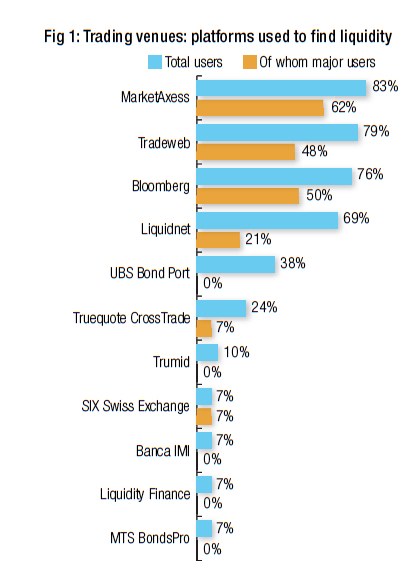

In 2019, the most popular trading venue for finding liquidity is MarketAxess with 83% total share of users, of which 62% are ‘Major Users’ (see Fig 1), followed by Tradeweb with 79% of traders using it, 48% being ‘Major Users’, and Bloomberg being used by 76% of traders to find liquidity, 52% of those being ‘Major Users’. Block-trading specialist Liquidnet, is being used by 69% of respondents, and UBS Bond Port has maintained its role as the broker platform of choice, amassing a 38% share of users.

In 2019, the most popular trading venue for finding liquidity is MarketAxess with 83% total share of users, of which 62% are ‘Major Users’ (see Fig 1), followed by Tradeweb with 79% of traders using it, 48% being ‘Major Users’, and Bloomberg being used by 76% of traders to find liquidity, 52% of those being ‘Major Users’. Block-trading specialist Liquidnet, is being used by 69% of respondents, and UBS Bond Port has maintained its role as the broker platform of choice, amassing a 38% share of users.

The highest growth in users came from TrueQuote’s CrossTrade, which is a specialist internal crossing tool. It has gained use by 24% of respondents in a single year, with 7% of traders already being ‘Major Users’.

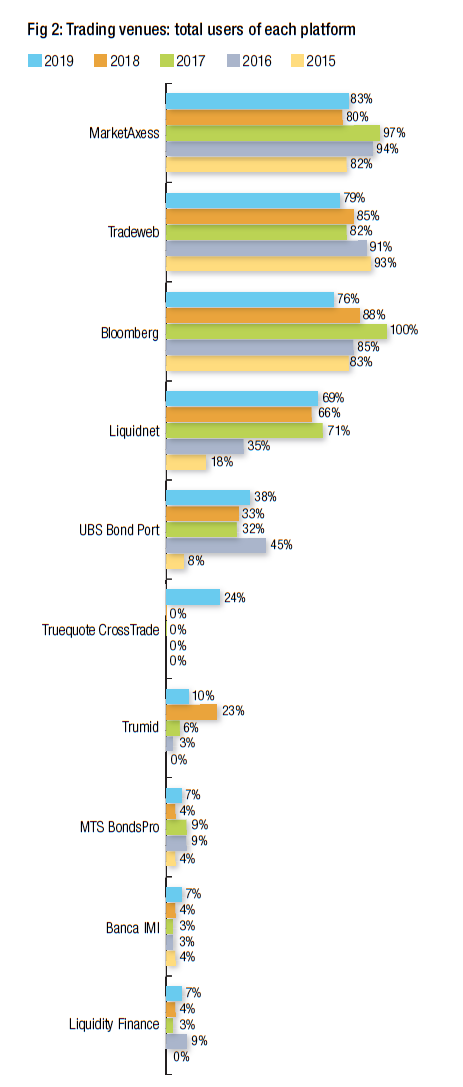

The last four years saw overall usage of platforms spike in 2016/17, followed by a subsequent drop across the big four – MarketAxess, Tradeweb, Bloomberg and Liquidnet – in 2018 (see Fig 2), when smaller platforms increased their share. The level of reliance that some traders had on the big four, based on their number of ‘Major Users’, increased up until 2018.

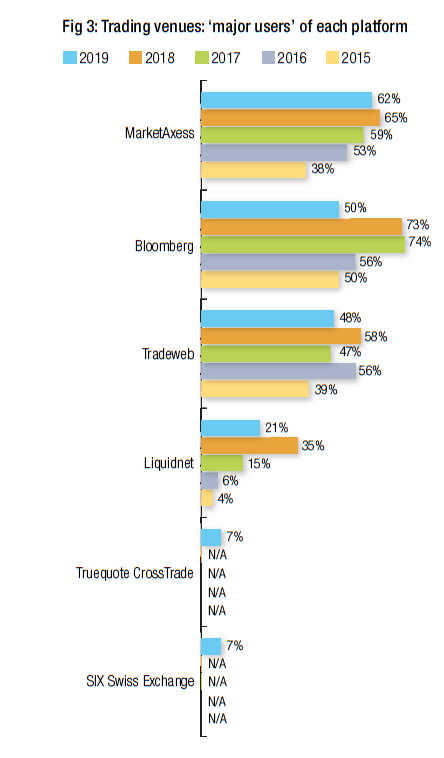

That trend appeared to stop in 2019, as overall use levels for the larger venues plateaued in the 75-85% range, while their share of ‘Major Users’ declined. For MarketAxess and Liquidnet, overall users increased at this time, suggesting a reduced concentration of activity by some traders this year. At the same time two new entrants, TrueQuote CrossTrade and SIX Swiss Exchange, broke the 5% mark for ‘Major Users’ (see Fig 3).

Longstanding platforms, notably Trumid in the US and MTS’s BondsPro and emerging market specialist Liquidity Finance, have repeatedly broken the 5% barrier for total users, but have not gotten more than 5% of traders as ‘Major Users’.

Looking ahead, traders are engaging heavily with Tradeweb’s China Bond Connect offering, BGC FENICS and TrueQuote’s VolumeMatch in 2019 (see Fig 4), a potential indicator of future growth. Liquidnet, Bloomberg China Bond Connect and TrueQuote’s LiquidityChain and ScrapBook tools also have strong pipelines for potential growth.

The winners: Data & analytics providers

• Most used to find liquidity: Bloomberg

• Greatest ‘major use’ to find liquidity: Bloomberg

• Greatest growth: MarketAxess Composite+

• Greatest engagement for future: Algomi / Neptune

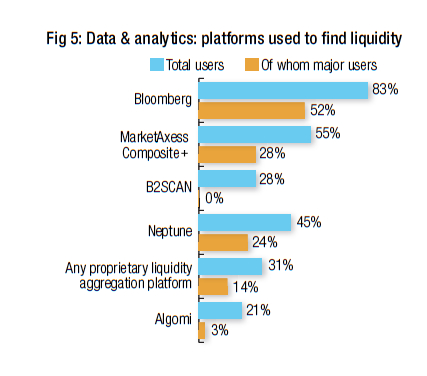

Bloomberg is the leading provider of pre-trade data & analytics in 2019, with 82% of traders using it to find liquidity (see Fig 5) and 50% of traders rating themselves as ‘Major Users’. In a promising second place is MarketAxess’s Composite+ tool, which also saw the most growth in the sector, amassing a user base of 58% – 29% of whom are ‘Major Users’ – having only launched in early 2018. Neptune’s axe messaging platform is used by 46%, and proprietary tools have continued to gain popularity, being used by 32% of traders. Both B2Scan (29%) and Algomi (22%) have maintained their strong user bases.

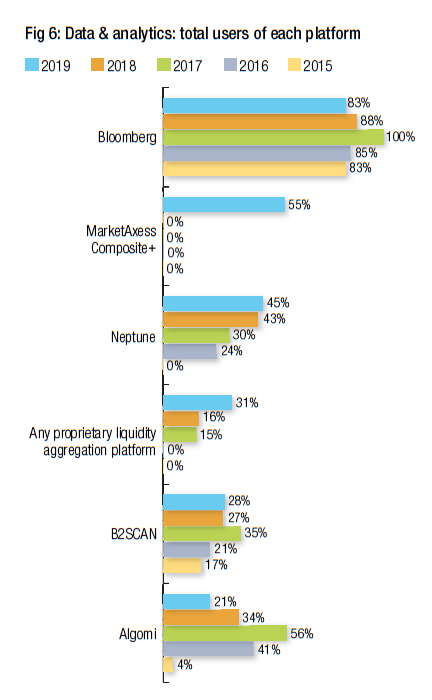

What really stands out over the longer term (see Fig 6) is how use of platforms – based on total and major use – has changed. The employment of data and analytics platforms saw a spike in 2017 – as it also did for trading venues – with Bloomberg, B2Scan and Algomi all hitting record usage levels that year. Activity subsequently fell, then flattened out.

A trend in the other direction has been the growth in share for tools like Neptune, proprietary liquidity aggregation tools, and most recently for MarketAxess’s Composite+ tool.

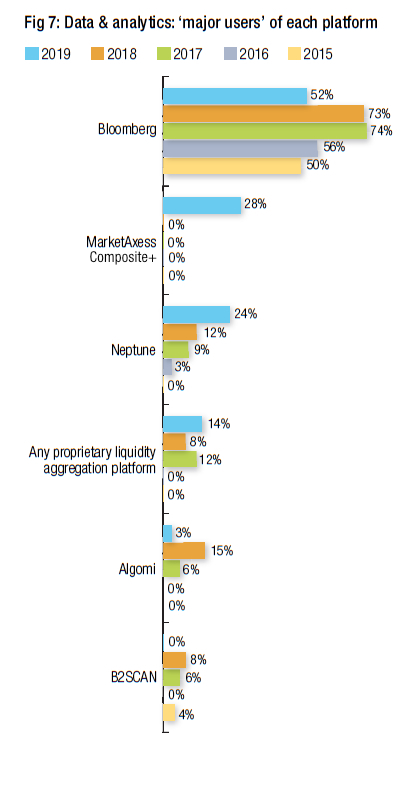

That trend has also been reflected in the growth of Major Users across those platforms (see Fig 7). Half of traders using MarketAxess’s Composite+, the second most widely used pre-trade tool, classify themselves as ‘Major Users’, as do 20% of traders for Neptune.

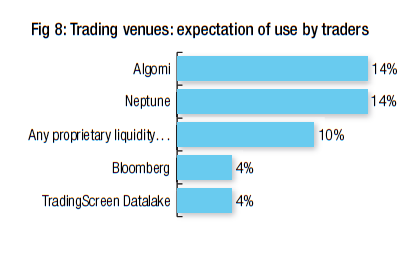

The most promising levels of engagement for the future come from Algomi and Neptune (see Fig 8), which are each working with 14% of traders that responded to the survey. Proprietary liquidity tools are still being developed by 10% of respondents.

The winners: O/EMS

• Most used to find liquidity: Aladdin / Charles River

• Greatest ‘major use’ to find liquidity: Aladdin / Charles River

• Greatest growth: N/A

• Greatest engagement: TradingScreen TradeSmart

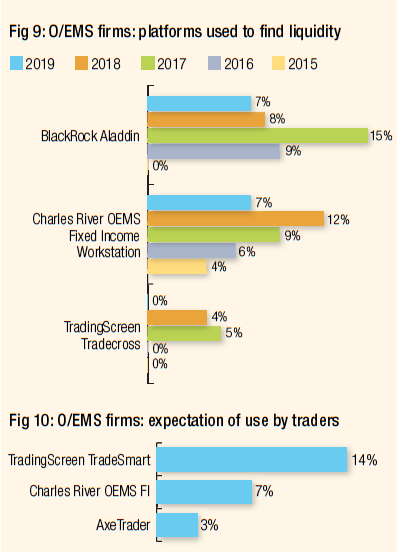

State Street’s acquisition of Charles River in 2018 created a proxy head-to-head situation between two major passive investment houses, as BlackRock and State Street Global Advisors have each got a corporate link to the popular E/OMS tools, Aladdin and the Charles River OEMS Fixed Income Workstation.

Both Aladdin and Charles River have clocked up a 7% usage in 2019, all of which came from traders classifying themselves as ‘Major Users’. However, overall use fell for all O/EMS providers. With connectivity being an ongoing and constantly raised issue, it seems that the traders are still finding it challenging to use front office technology to effectively find liquidity.

TradingScreen has undergone a product refresh, with its TradeCross product being replaced by the TradeSmart platform which already has optimistic prospects (see Fig 10); 14% of traders say they are engaged with TradeSmart for the future, the highest level of engagement for any platform.

Most effective tools today and in the future

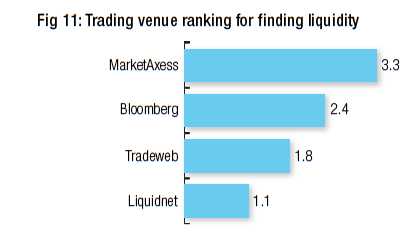

When asked to rank out of five which systems are most effective at finding liquidity, respondents’ opinion of venues roughly mirrored their usage (see Fig 11), with MarketAxess ranked in the lead, followed by Bloomberg and Tradeweb, with Liquidnet ranked fourth.

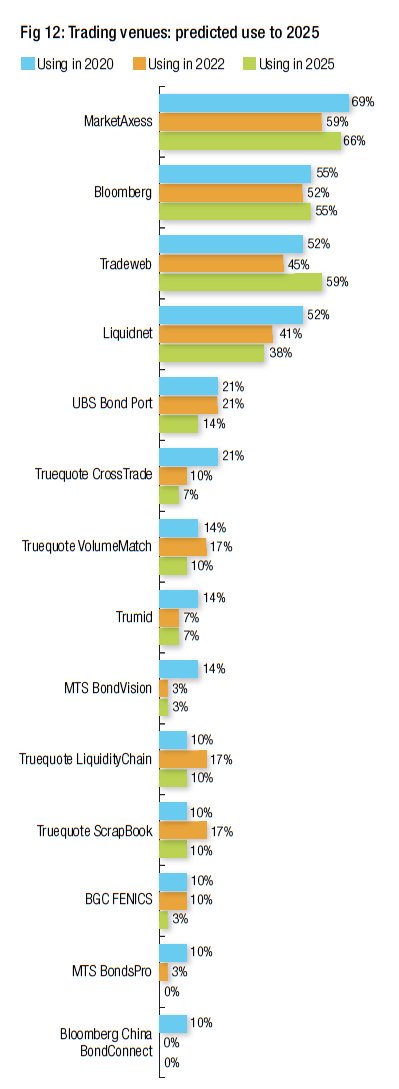

When asked to predict which venues they expect to continue to use to find liquidity in 2020, 2022 and 2025, beyond the big four – which have all received 50% or more support for at least one year (see Fig 12) – both UBS Bond Port and TrueQuote CrossTrade achieved over 20% support, with the MTS platforms, other TrueQuote platforms, BGC FENICS and Trumid, breaking past 10%.

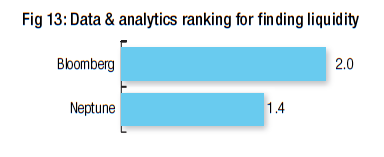

Across pre-trade data / analytics tools, Bloomberg is both most used and is seen as most effective in finding liquidity (see Fig 13), followed by Neptune.

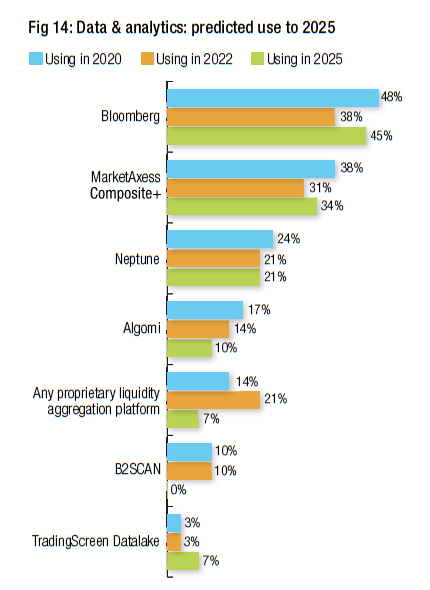

Over the short, medium and long term, Bloomberg, MarketAxess Composite+ and Neptune have the strongest votes of confidence amongst buy-side traders (see Fig 14) with only proprietary tools rising above the 20% mark. Algomi and B2Scan both consistently break the 10% barrier, while TradingScreen’s DataLake has traders’ confidence over the longer term, with a greater expectation of use in 2025 than in 2020. Despite the significant growth in data tools over 2019, longer term confidence levels are lower compared to those of trading venues.

Confidence across the O/EMS sector was less consistent, only Charles River achieved expected use from 10%+ of traders, for 2025.

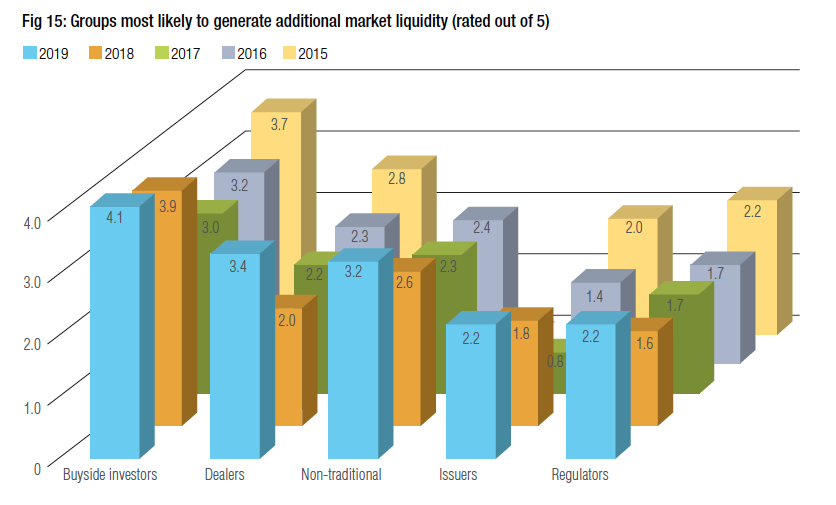

Each year we ask respondents which sector of the market is most likely to make a change that might generate market liquidity, particularly in light of potential regulatory initiatives, more standardised issuance, dealers being able to commit more balance sheet to support risk trades, and non-traditional liquidity providers engaging in the market.

This year saw an overall rise in confidence that most parties could effect greater liquidity, however the greatest increase was that dealers (sell-side firms) would be able to support that greater liquidity (see Fig 15).

©The DESK 2019

©Markets Media Europe 2025