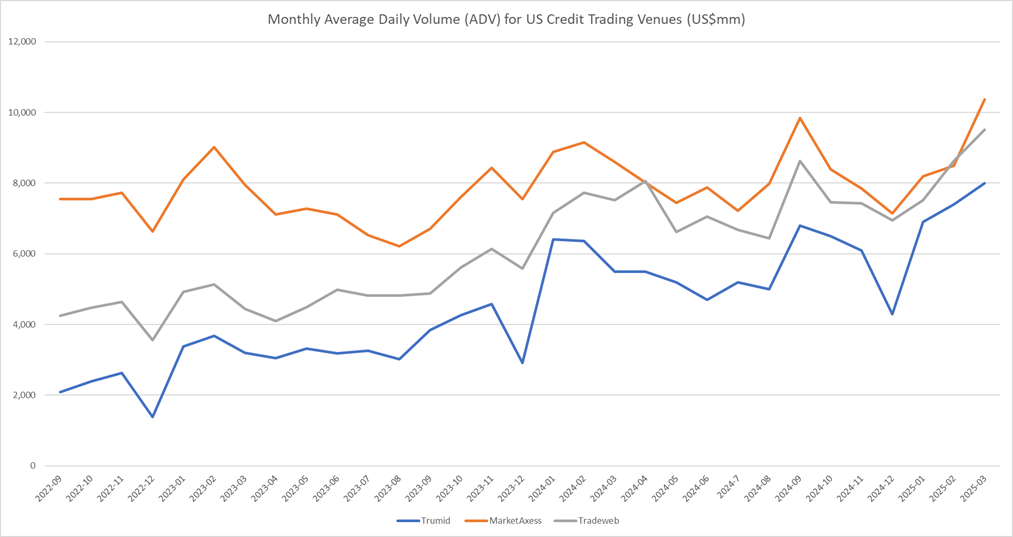

MarketAxess has regained the lead in US credit fully electronic trading amid a surge of activity in March with Trace printing a record US$61.2 billion average daily volume (ADV). MarketAxess reported fully electronic US credit trading at US$10.4 billion ADV, Tradeweb reported fully electronic US credit trading at US$9.5 billion ADV, and Trumid US credit trading at US$8 billion ADV.

According to Morgan Stanley Research, MarketAxess has experienced a significant volume surge despite some competitive headwinds. For March, the firm reported a 20% year-over-year (YoY) increase in US investment grade (IG) credit volumes and a 25% rise in US high yield (HY) volumes. However, these gains were accompanied by modest market share declines – US IG market share fell by nine basis points to 19.2% and US HY by 20 basis points to 12.5%. Morgan Stanley attributes this slight erosion to intensified competition amid the rapidly evolving electronic credit market.

Volumes in fully electronic trading for IG credit were US$8.7 billion, US$1.7 billion for HY bonds, US$4.1 billion for emerging markets bonds , and US$2.7 billion for Eurobonds.

Tradeweb, meanwhile, has posted gains in both key credit segments. Its US IG fully electronic credit volumes increased by 25% YoY to US$8.5 billion, while US HY volumes surged by 44% YoY to US$1 billion This level of activity helped Tradeweb gain market share: US IG credit market share improved by 31 basis points, reaching 18.4%, and US HY credit by 133 basis points to 7.6%.

Trumid continued its rapid volume growth to US$8.0 billion ADV. It does not disclose the split between fully electronic trading and electronically processed trades.

Morgan Stanley’s analysis also suggests that despite some margin pressure from fee compression, innovations such as targeted block trading solutions (notably on MarketAxess) and advanced RFQ protocols (prominent on Tradeweb) could drive revenue upside in the coming quarters.

Trumid CEO Mike Sobel was pleased with the firm’s Q1 performance.

“This was our strongest month and quarter yet – a testament to our clients’ trust in Trumid as their go-to destination for electronic credit trading,” he said. “From deep protocol adoption to record-setting volume and market share, momentum was platform-wide, reflecting deepening network engagement. A record US$8.0 billion ADV traded on Trumid in March, up 46% YoY.”

MarketAxess’ CEO Chris Concannon was equally pleased, stating:“Our record trading results in March, combined with the progress we are seeing from the enhancements we have made to our portfolio trading solution, the launch of our high touch block trading solution in Eurobonds and emerging markets, and our dealer solutions offering, helped drive our record Q1 ADV performance.”

Billy Hult, CEO at Tradeweb, recognised the influence of volatility on overall volumes, noting:

“Electronic trading remained sticky and resilient across asset classes on Tradeweb, as market share gains and heightened market volatility helped drive record volume for the month of March and for the first quarter.”

©Markets Media Europe 2025 TOP OF PAGE