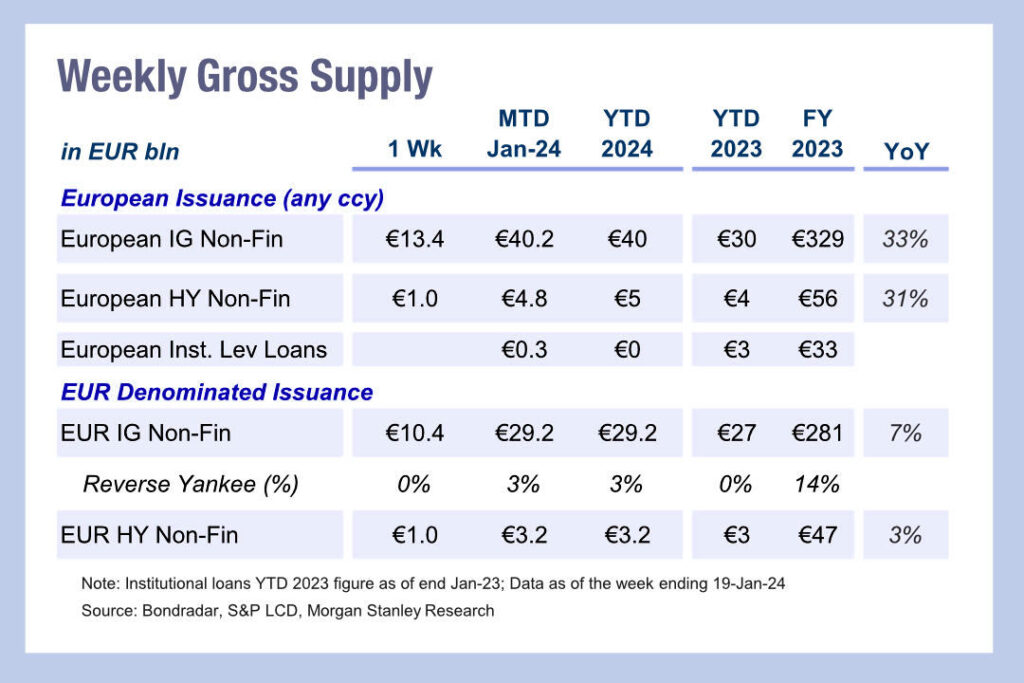

Debt markets are looking bloated in Europe, with a 33% increase in European non-financial investment grade issuance year-on-year (YoY) year-to-date and a 31% increase in non-financial high yield, according to analysis by Morgan Stanley. Specifically in Euro-denominated issuance the increase has been 7% IG and 3% HY.

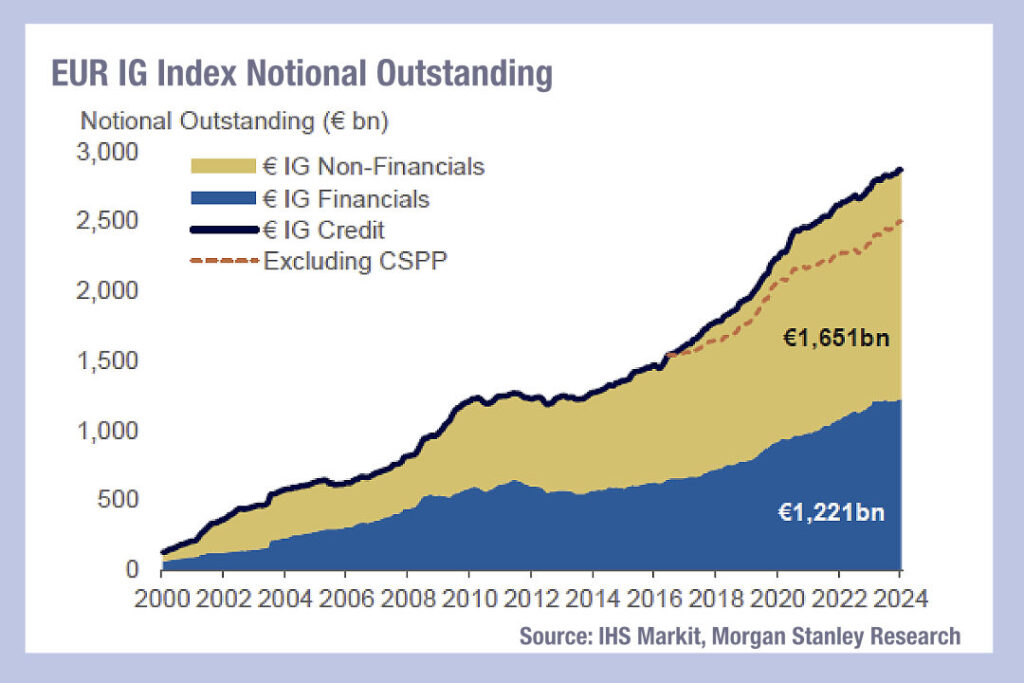

This whacking great number of bonds is expected to continue to grow significantly over 2024 according to buy-side traders, who are seeing the limits of market appetite tested by the size of debt issuance, making it a buyer’s markets. The level of IG indexed credit issued by non-financials year-to-date is €1.65 trillion, and €1.22 trillion for financials. High quality credit is a welcome home for cash fleeing riskier markets, including those investors seeing a retreat from Asia Pacific.

This whacking great number of bonds is expected to continue to grow significantly over 2024 according to buy-side traders, who are seeing the limits of market appetite tested by the size of debt issuance, making it a buyer’s markets. The level of IG indexed credit issued by non-financials year-to-date is €1.65 trillion, and €1.22 trillion for financials. High quality credit is a welcome home for cash fleeing riskier markets, including those investors seeing a retreat from Asia Pacific.

Nevertheless, questions are being asked about the total debt outstanding relative to gross domestic product. Government debt is hard pressed to find buyers, with international state-backed buy-side stepping back, and limited yield relative to other bonds. With such high levels of debt across the board, this potential which has been released early by investors, must at some point be either realised or defaulted upon, and the threat from macro events is high on the radar of many institutional investors.

Nevertheless, questions are being asked about the total debt outstanding relative to gross domestic product. Government debt is hard pressed to find buyers, with international state-backed buy-side stepping back, and limited yield relative to other bonds. With such high levels of debt across the board, this potential which has been released early by investors, must at some point be either realised or defaulted upon, and the threat from macro events is high on the radar of many institutional investors.

©Markets Media Europe 2024

©Markets Media Europe 2025