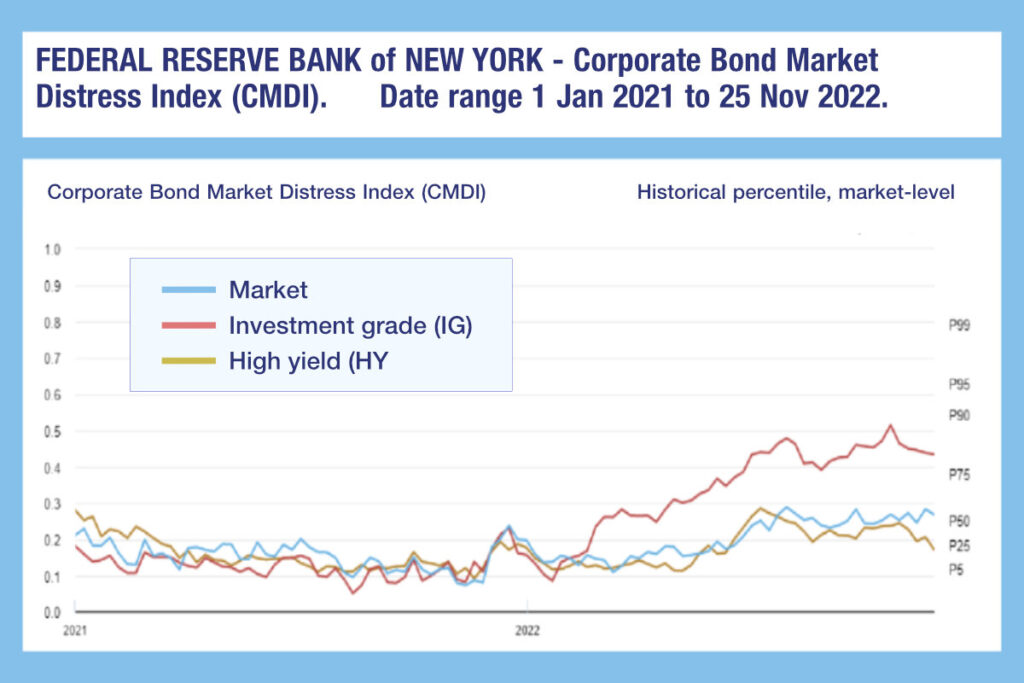

The Federal Reserve Bank of New York’s Corporate Bond Market Distress Index (CMDI) is closing 2022 with investment grade US bond markets twice as distressed as high yield. This peculiarity sets up 2023 for an interesting period.

US IG credit markets have seen far fewer concerns around trading quality than European markets, or US high yield. The CMDI assesses primary and secondary market factors and as noted last fortnight, it is issuance that has dropped off and created stress.

The question is how this might be experienced by traders. A liquidity event could be the result of poorer primary liquidity and reduced secondary market liquidity. Such an event need to be ridden out rather than countered, but traders will have to consider their approach if to finding the other side of a trade in highly strained conditions.

This has historically been the space where a non-comp portfolio or block trade might be sought via a preferred dealer, in order to get certainty of execution over price improvement by putting dealers in competition.

It may be that banks are still holding debt from hung deals and cannot add further risk to their books. Certainly there have been M&A deals which left leaving debt on the table with the acquisition target reportedly struggling to deliver revenue targets in order to service the debt.

Keeping strong dealer relationships has proven its value in 2022 and that will continue to be true in the new year. There can also be major advantages to accessing predictive analytics, pre-trade data and market stress analytics, in order to pre-empt events where possible and position for them

©Markets Media Europe 2025