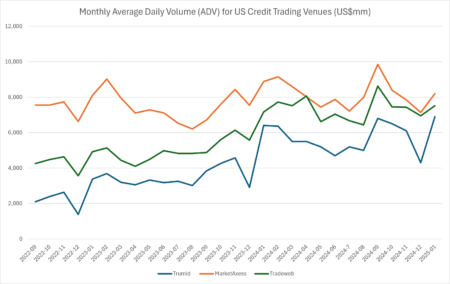

Electronic credit markets started 2025 on a strong note, with January’s total credit average daily volume (ADV) showing robust growth across platforms. Trumid reported continued market share gains.

Tradeweb reported fully electronic U.S. credit ADV of US$7.5 billion, marking a 5% increase year-over-year. This growth was driven by the platform’s request-for-quote (RFQ), portfolio trading, and Tradeweb AllTrade adoption.

In the U.S. high-grade market, Tradeweb captured 17.5% of fully electronic TRACE, while its high-yield credit ADV stood at 7.7% market share. European credit ADV declined 3.9% YoY toUS$2.4 billion, affected by broader market volatility.

MarketAxess posted a total credit ADV, comprising High Yield, Investment grade, Munis, and eurobonds ofUS$14.5 billion, down 3% year-over-year, but showing a strong 18% increase from December due to seasonal factors. U.S. high-grade ADV dropped 8% YoY toUS$6.9 billion but increased from December’s levels. U.S. high-yield ADV was also down 8% YoY toUS$1.3 billion, but showed positive momentum compared to the previous month. Emerging markets ADV saw a 2% YoY decline toUS$3.6 billion, despite record block trading in hard currency bonds. Eurobonds ADV increased 8% YoY toUS$2.1 billion, fueled by a 219% surge in portfolio trading volume. Dealer RFQ activity hit a recordUS$1.5 billion ADV, up 23% YoY and 45% from December, signaling increasing buy-side adoption. Market share remained stable from December levels, indicating resilience amid competition.

Trumid continued its rapid growth trajectory, reporting a record ADV ofUS$6.9 billion, up 8% year-over-year. The platform gained 6% more market share YoY in U.S. investment-grade and high-yield corporate bonds. Trumid RFQ volume doubled YoY, with a 40% increase month-on-month. Trumid AutoPilot RFQ saw 80% of eligible trades executed “no touch”, highlighting the strength of its automation capabilities. Trumid portfolio trading (PT) lists more than doubled year-over-year.

According to Coalition Greenwich Bloomberg’s US electronic credit trading ADV was US$ 2.8 billion for January 2025.

©Markets Media Europe 2025