European banks reported a strong showing in fixed-income trading during the final quarter of 2024, buoyed by elevated client activity across rates, credit, and emerging markets. Deutsche Bank, BNP Paribas and Barclays had strong year-over-year revenue growth.

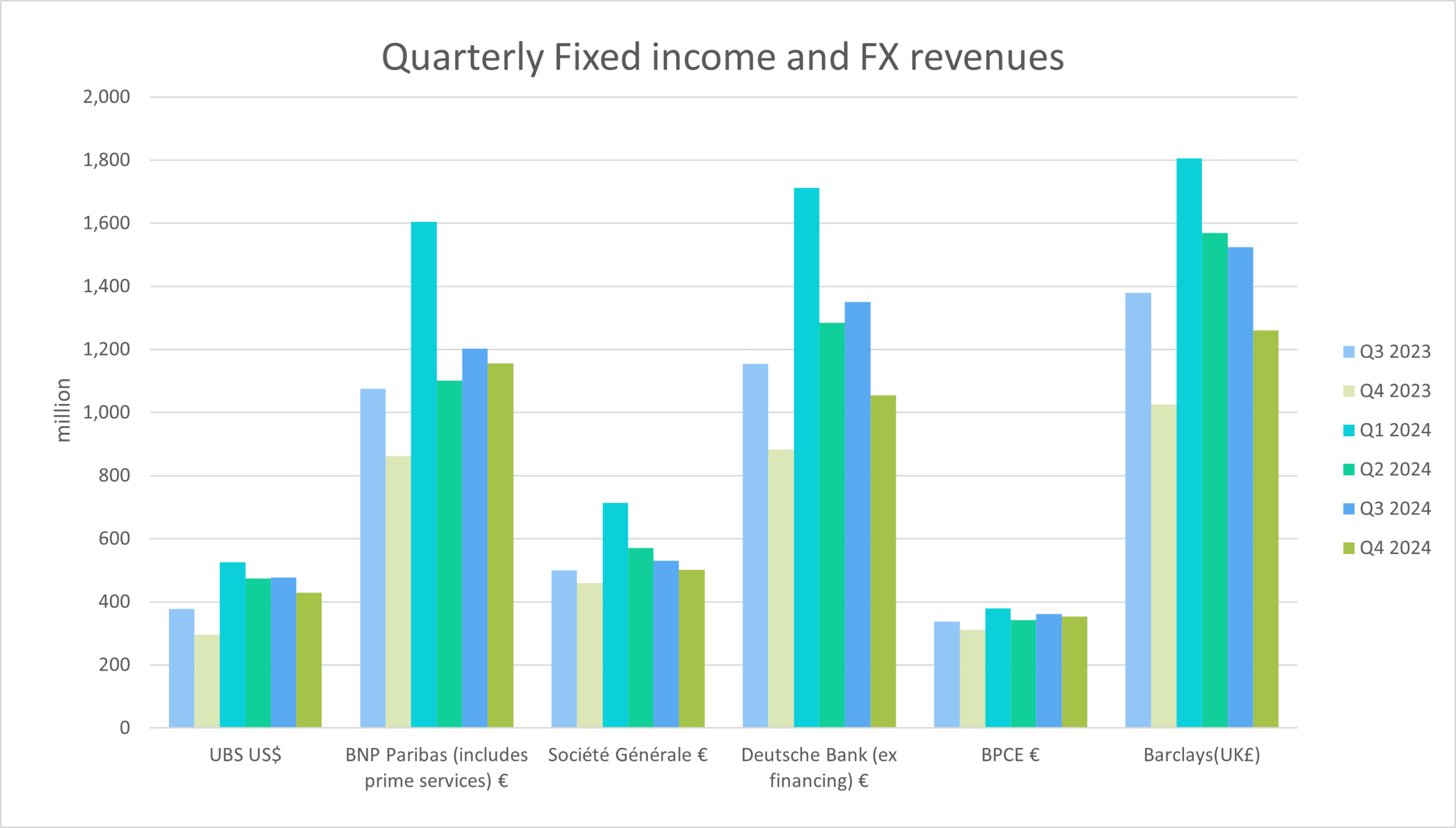

Deutsche Bank’s Fixed Income and Currencies (FIC) division delivered €1.06 billion in revenues for Q4 2024, up 19.5% from €883 million in Q4 2023, but below the €1.35 billion recorded in Q3.

During its quarterly earnings presentation, the bank noted: “FIC transformation continues to drive increased client activity and consistent financing growth”.

It highlighted successes in rates, credit trading, and emerging markets. Deutsche Bank also saw a 12% increase in FIC financing, supported by stronger client flows and deeper liquidity provision.

BNP Paribas posted €1.16 billion in Q4 fixed income revenues, a 34% jump from €861 million in Q4 2023, despite a small dip from €1.2 billion in Q3. The bank emphasised a 32% rise in global market activities, propelled by robust FX trading, strong structured products, and a growing primary issuance pipeline.

Barclays, which released its FY24 results this morning, reported £934 million in Q4 fixed income revenues, 29% higher than the £724 million figure in Q4 2023, though down 21% from Q3. According to the bank, the year-on-year growth reflected healthy activity in rates and credit trading.

CEO C.S. Venkatakrishnan noted: “Within fixed-income trading, we had a weaker start to the year in macro trading and European rates, but we have begun to see momentum in those businesses again. The house of Barclays was built on fixed income. I’m very confident about fixed income performance going forward.”

UBS benefitted from its Credit Suisse integration. It posted US$429 million in fixed income revenues in Q4 2024, a 15.2% drop from Q3 2024’s US$477 million but up 45% year on year.

It reaffirmed its commitment to building its fixed-income platform and stated: “We are actively strengthening our fixed-income trading capabilities, leveraging our expanded client base and risk management expertise.”

The firm also pointed to enhanced product offerings and greater integration of its FX and credit trading desks as key growth drivers in 2025.

Société Générale’s Q4 fixed income revenues rose 9% year on year to €501 million, off slightly from €530 million in Q3; BPCE recorded €354 million, up 13.8% from the prior year.

European banks see further positive prospects in fixed-income and forex aided by strong hedging demand and persistent market volatility. Deutsche Bank and Barclays anticipate that liquidity-driven client flows will continue driving rates, credit, and emerging markets trading.

BNP Paribas CEO Jean-Laurent Bonnafe echoed that optimism: “We expect ’25 is going to be a year with a lot of volatility for a lot of reasons. So global markets and CIB globally will deliver probably much more than the consensus is telling us today.”

©Markets Media Europe 2025