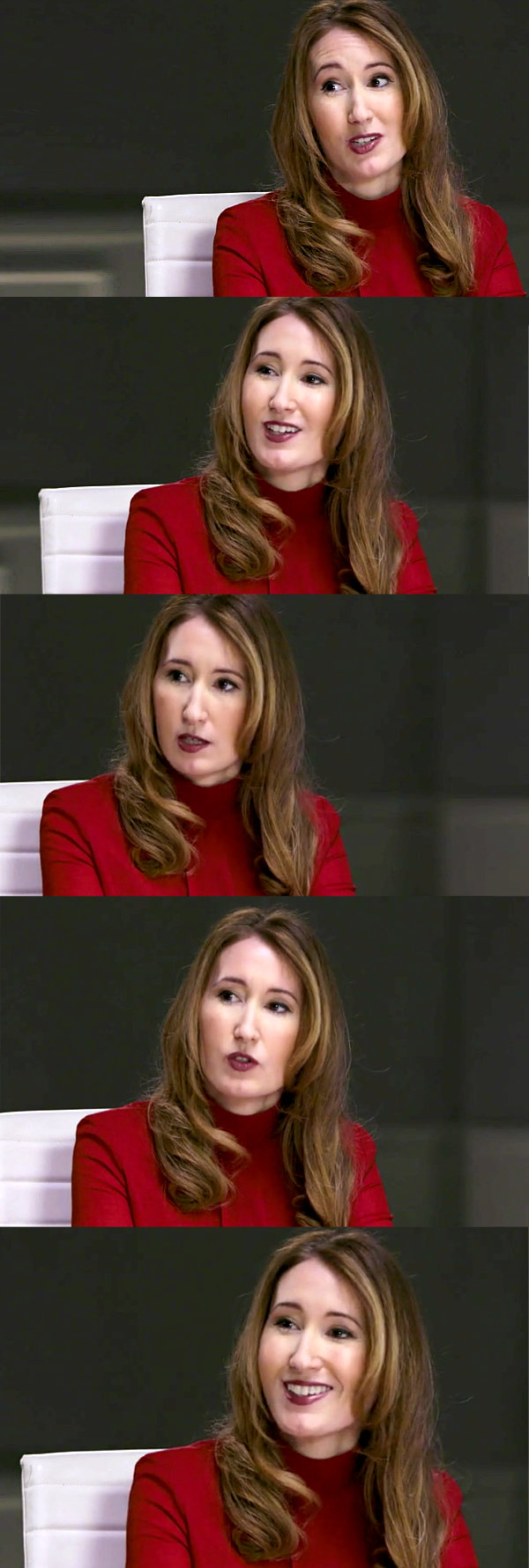

Madelaine Jones, portfolio manager for the European high yield and senior loan strategies at Oaktree Capital Management, talks to Lynn Strongin Dodds about lessons learnt, creating career paths and staying engaged.

Although Covid-19 is an unprecedented event, Madelaine Jones, portfolio manager for the European high yield and senior loan strategies at Oaktree Capital Management, is no stranger to setbacks, having navigated the global financial crisis and more minor bumps along her 20-year career. The dynamics may differ today but in many ways the strategy remains the same – stay calm and look for the most promising prospects.

“You can’t predict every event but there will always be risk on and risk off market cycles,” says Jones who is also co-manager for the global high yield strategy and head of the firm’s EMEA Diversity & Inclusion committee. “The covid-19 situation is not the same, but investor behaviour is similar to other crises.”

She adds, “I am always the most fearful when everything seems to be going well and investors are at their most relaxed, but are not getting paid appropriately for unseen risk. There is a false sense of security. But the market had a wake-up call this year, and as in the past there followed a dramatic move and a shift to being perhaps overly defensive from not being defensive enough.”

This was exactly the scenario in March when the virus seemed out of control in many parts of the world. Central banks acted swiftly pumping trillions of sterling, yen, euros and dollars into the system which triggered a flight into safe haven assets and an exodus from the riskier instruments. European high yield bonds and loans were particularly hard hit at the end of the first quarter with rapid price deterioration and sell-offs.

Companies across the spectrum, even those that were fundamentally sound with a low risk of default and strong balance sheets were punished, according to Jones. However, “this is also the time when you have to hold your nerve, recalibrate, be mindful of the risks but look for the sound companies that are heavily discounted,” she adds.

Jones says that senior members of the team who have on average 20 years of experience investing across multiple credit cycles were well equipped to ride out the storm, extract value and find the right opportunities in the current environment. In fact, they began to reposition their portfolios defensively before the virus took hold against an optimistic market mood. In addition, the portfolios were already well diversified which Jones says “is a cheap form of protection” especially when there is a single event.

Their success was partly down to the detailed research that is undertaken to assess companies and a skill that attracted Jones to her first job as a financial analyst. “I have always had an interest in understanding how successful companies continued to succeed,” she says. “This led me to study economics and then I went straight from university to a job in debt capital markets.”

The linear path led her to Deutsche Bank in 2000 as an associate in leverage finance origination where she was exposed to a wide spectrum of corporates across a range of sectors. At the time, the German based bank was top of the league table and as Jones notes, “the transactions were prolific, as such it was the best place to learn.”

After three years, Jones decided to make the move from the sellside to buyside in order to assess companies over a longer time horizon. It also allowed her to sharpen her financial analyst acumen as well as learn a new skill – the art of management. However, she wanted to stay in the high yield and loan space because of their constantly changing and stimulating nature.

Oaktree was a perfect fit because at the time – 2003 – it was a pioneer in European high yield and “a great place to learn the skills of credit investment,” she says. Jones further enhanced her education by studying in the evening and weekends for the rigorous chartered financial analyst qualification.

Seventeen years later and Jones is still learning and being challenged., She is also looking to bolster and develop her team which numbers nine investment professionals. “We continued hiring through the pandemic because we do not want to wake up and be surprised by a lack of resources,” she adds. “We know that the economic conditions will be difficult, so we want to make sure that we have the depth of skills to analyse companies.”

While talent is a criterion in the recruitment process, Jones is also looking for people who are not afraid to debate and discuss. She sees her job as unlocking potential and encouraging people to air their views even if it means going against “group think.”

Not surprisingly, creating a collegiate environment is not that easy in a remote working environment. “We are used to seeing each other in person and sharing information and exchanging ideas,” she says. “When lockdown happened, we had to replicate this to the best of our ability. As a firm, we made sure that we had the communication processes and connectivity that allowed the free flow of information across teams and geographies. Human capital is our greatest asset and we made sure that our employees were well supported in every way when lockdown happened, but also now.”

While the office is now open and it is up to individuals to return or not, Jones believes that flexible working arrangements will be one of the long-term outcomes of lockdown. “If we get this right, then I think this could be beneficial for the diversity agenda, before, people were not totally comfortable with virtual communication platforms. Covid-19 has accelerated the technology shift.”

Oaktree in general has been at the forefront of fostering diversity and inclusion. There are several different layers across the firm, ranging from awareness and outreach programmes to mentorships, recruitment initiatives, internships as well as informal networks where staff can congregate and engage.

Jones, who has been heavily involved as head of the EMEA branch of the firm’s diversity and inclusion committee, notes they take a holistic view that not only encompasses gender but also other disadvantaged groups who are underrepresented in the industry.

“The Black Lives Matter protests allowed more light to be shed on the fact that there are other significantly underrepresented groups of people in financial services,” she adds. “There is a clear step change in awareness and dialogue. However, it is about more than just recruitment, but also retention. We need to invest in and develop career pathways for groups who have not had them in the past.”

©Best Execution & The DESK 2020

©Markets Media Europe 2025