Dan Barnes

CEO, Europe

Latest From Dan Barnes

Trading Intentions Survey 2025

The battle for pre-trade analytics The 2025 Trading Intentions Survey canvassed 40 buy-side trading desks across asset managers headquartered in Europe (52%) and the US (48%), to understand which platforms and service they are using to picture,...

Read more

Asia close: Trading desks report tariff impact muted, US open tense

Following Asia market close, trading desks are reporting that the greatest impact from the US tariffs is expected to be seen upon market open in the US today. “Asia is fine, US are shooting themselves in the foot, so the larger risk off moves wi...

Read more

Exclusive: Competition fails to cut prices for FX dealers

When Bloomberg announced, in Q4 2024, that it was to start charging dealers for using FXGO, its foreign exchange trading service, a number of sell-side firms were up in arms. The additional costs would amount to between US$5-10 million dollars a y...

Read more

Direct streaming on credit trading platforms

Sell-side bond trading counterparties price trades according to their clients’ profiles, based on tiering systems. That model directs the pricing of risk according to the level of business that dealers see from their buy-side counterparties. This ...

Read more

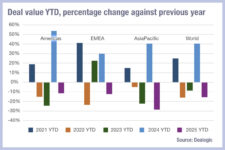

Debt deals decline

Debt markets have seen a year-on-year (YoY) decline in deal activity in 2025, according to data from Dealogic, reflecting the pensive mood amongst corporations and governments. Globally, deal value year-to-date (YTD) fell by 16% against the sam...

Read more

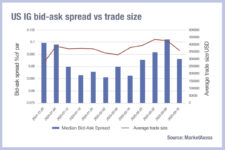

Is rising credit risk displaying in bid-ask spreads?

US credit markets are seeing a divergence in bid-ask spreads and trade sizes between high yield and investment grade bonds, according to data from MarketAxess’s TraX, which tracks activity across multiple bond markets, and its CP+ pricing data. T...

Read more

Janus Henderson: On the psychology of the trade

Janus Henderson’s senior fixed income traders, led by Andy ‘Mungo’ Munro, discuss the psychology of trading, transferring experience and effective leadership. How are your trading desks organised? Andy Munro: Janus Henderson has offices in L...

Read more

UPDATED: UBS continues to swing axe

UBS, the investment banking giant has reportedly cut further jobs from its markets division, with many people internally fearing more jobs are to go, according to multiple sources. Earlier this week the bank announced that it was cutting its Exec...

Read more