Alex Pugh

Reporter

Latest From Alex Pugh

Houlihan Lokey appoints Clinton Miyazono to capital markets group

Houlihan Lokey has named Clinton Miyazono managing director in its capital markets group. Miyazono will support the firm’s credit capabilities out of the firm’s Chicago office. Miyazono joins the firm from D.A. Davidson Equity Capital Markets, wh...

Read more

ION connects to FMX Futures Exchange

ION has connected to the FMX Futures Exchange, which opened on 23 September 2024, meaning clients can now trade on the newly launched exchange through ION’s execution and post-trade product suite. BGC Group and ten global investment banks and mar...

Read more

TD Bank joins LTX as liquidity provider

TD Bank has joined AI-powered corporate bond trading platform LTX’s e-trading platform, via its subsidiary TD Securities Automated Trading. TD Bank will contribute axes, or pre-trade indications of interest, to LTX’s Liquidity Cloud and utilise L...

Read more

Investor Demand: European fund managers bullish on US, China in 2024

European fund managers are increasingly bullish on the US economy, with 42% of respondents to an October Bank of America survey expecting a robust US economy over the coming months. That figure is up from 18% last month, following a positive US j...

Read more

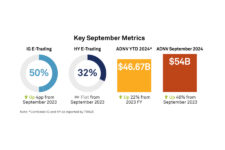

September: US corporate bond ADNV hits $54bn, up 46% YoY

The average daily notional volume (ADNV) for US corporate bonds hit a new high of US$54 billion in September 2024, a 46% increase compared to September 2023. The increase in volume was driven by the Federal Reserve’s rate cut and a surge in new i...

Read more

September: US rates ADNV up 35% YoY amid wider uncertainty

In September, overall trading in US rates rose 1% year-over-year, standing at 59% of volumes, while the average daily notional volume stood at US$988 billion, up 35% year-over-year. US Treasury markets were “unsurprisingly active” following the F...

Read more

Piper Sandler builds out fixed income team with Brian Vescio hire

Investment bank Piper Sandler has appointed Brian Vescio as managing director and head of structured products trading to the firm’s fixed income team. He will be based in New York. Vescio joins the firm from StoneX Group, where he was a ma...

Read more

Morgan Stanley an outlier as banks see FI trading revenues drop

In the third quarter of 2024, of five major banks – Citi, JP Morgan, Goldman Sachs, Bank of America and Morgan Stanley – only one saw fixed income trading revenues increase year-over-year. Morgan Stanley reported a 2.9% increase year-over-year in...

Read more