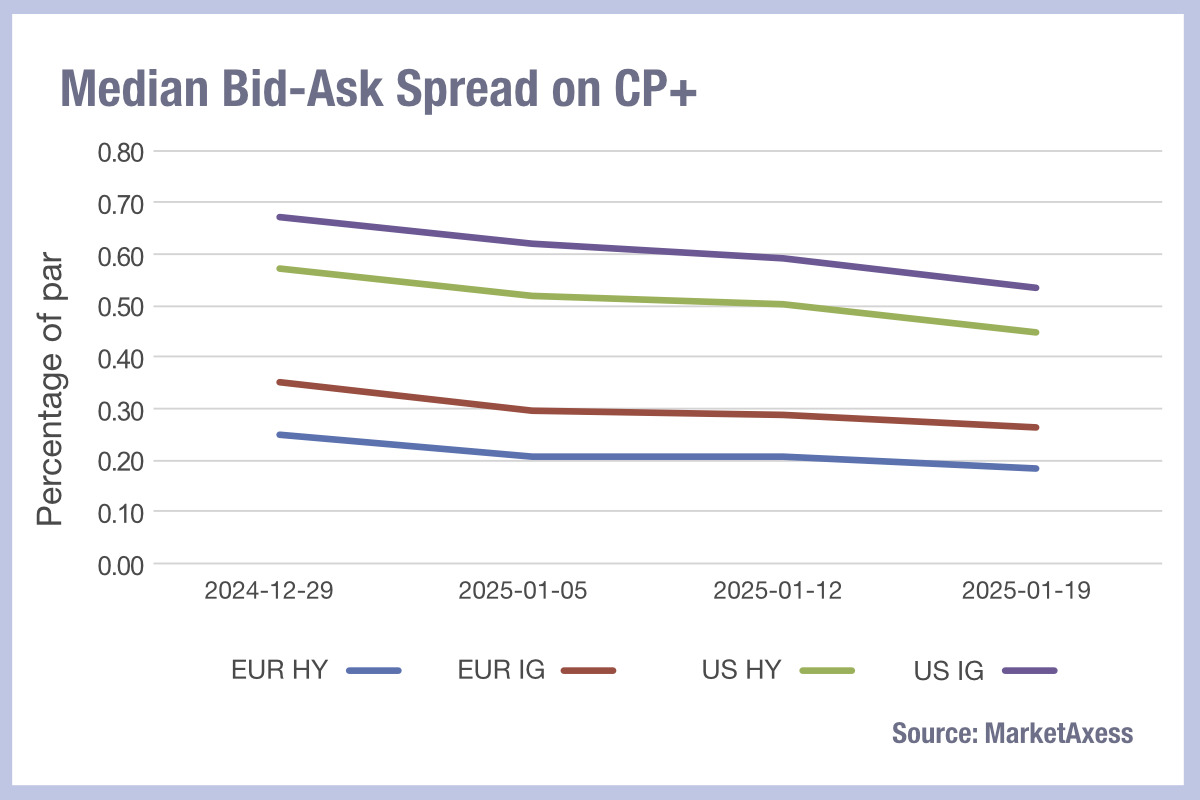

Bid-ask spreads in the corporate bond space have continued to collapse in 2025, suggesting that liquidity costs are dramatically improving for buy-side traders.

Looking at data from MarketAxess’s CP+ pricing service, median bid-ask spreads for investment grade debt have fallen from 0.1% of par to 0.08% of par in European markets and from 0.9% to 0.8% in the US.

High yield bonds have seen median bid-ask spreads drop form 0.25% of par to 0.18% in Europe and from 022% of par to 0.18% in the US.

The consistency of this decline is in line with the overall trajectory of increased dealer risk taking and lower costs of risk transfer as electronic market makers support both buy- and sell-side trading, delivering increased liquidity provision without significantly greater capital costs

If this positive liquidity picture continues, trading desks may find themselves able to attack more strategic objectives at the start of the year, such as onboarding new data sources, new technologies including execution management systems and analytics packages, and reviewing broker relationships.

A considerable amount has changed in the past year, with the development of the consolidated tape, rapid advances in the scale of portfolio and automated trading, and dealer profitability.

Having some time to catch up with these developments would no doubt be welcome; the only barrier may be tackling the high level of issuance in credit that is still soaking up time on the desk.

©Markets Media Europe 2024