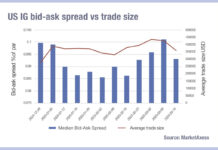

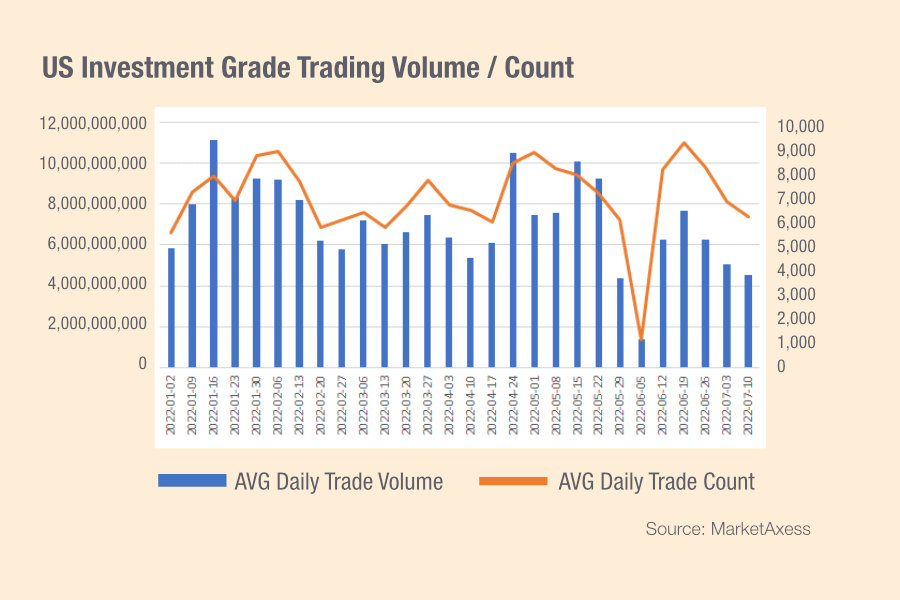

While liquidity in US investment grade (IG) markets has been holding up relatively well, MarketAxess data shows us that the past month has seen an exaggeration of the divergence between trade count – staying relatively high – and trade volume – falling away.

The correlation between the two has widened over the past six months and we are now seeing trade counts around the range of 5500-9000 per day, which has largely been consistent throughout the year.

That is a signal for the fragmentation of trades into smaller pieces. Sitting behind that may be several factors.

Firstly, the orders being received by trading desks may have reduced as rising rates see a reduction of holding ins secondary market assets and a rise in newly issued higher yielding assets.

Secondly, blocks might be harder to execute as dealers step back from offering balance sheet to trade on risk, thereby driving the buy-side to more electronic trading which has historically been used for smaller ticket sizes.

Thirdly, it may be that liquidity has fragmented, meaning that large orders are getting split up and traded across multiple counterparties to get filled.

In each of these scenarios it suggests that buy-side trading desks are increasingly stretched even when working at the most liquid end of credit.

©Markets Media Europe 2025