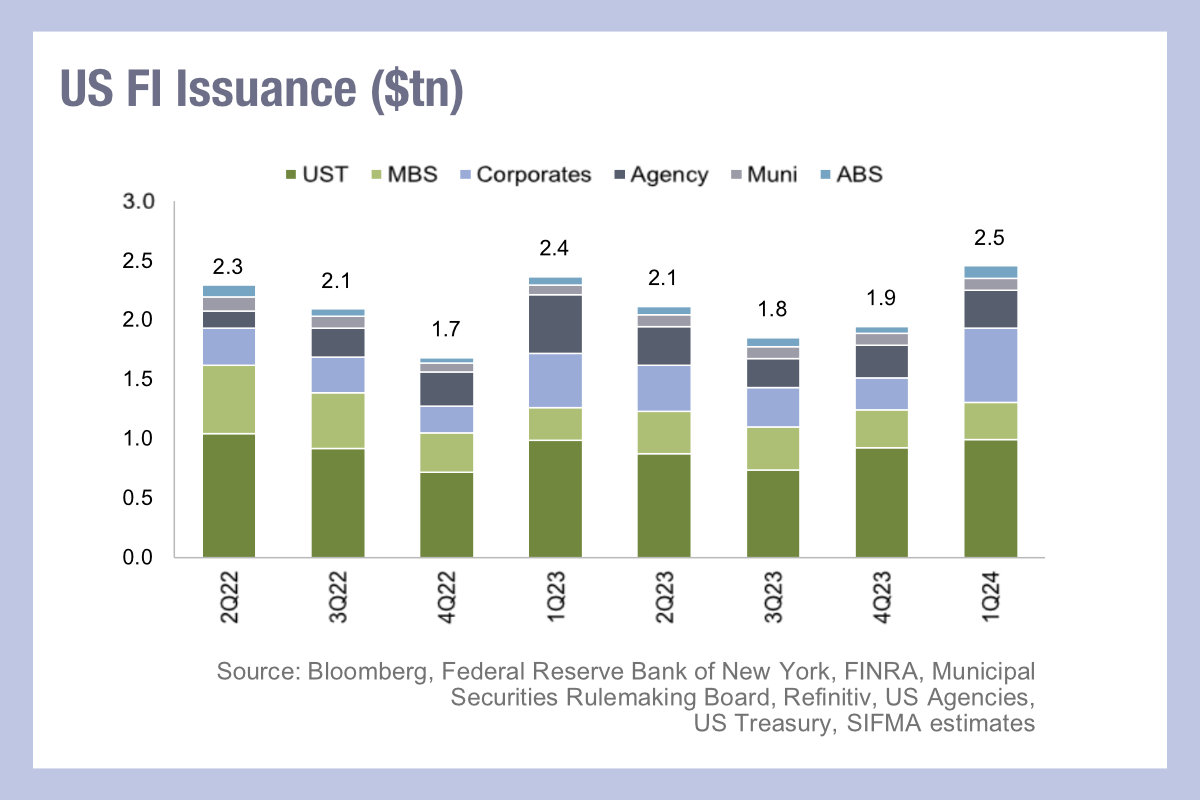

US fixed income markets saw issuance in Q1 2024 hit US$2.5 trillion according to the Securities Industry and Financial Markets Association (SIFMA), an increase of 26.1% quarter-on-quarter (QoQ).

The trade body reported that four out of six asset classes covered posted positive QoQ trends, ranging from +7.3% in US Treasuries to +135.8% for corporate bonds, the ‘star of the quarter’ which saw new issue value reach US$627.6 billion. Relative to 2023, the issuance seen in Q1 2024 represented 43.4% of total issuance US$1.4 in the previous year and 170% of last year’s average quarterly issuance.

SIFMA’s analysis of its full data time series going back to 1980 puts the last quarter as the second highest on record, only behind US$867.6 billion issued in Q2 2020. “Quarterly corporate bond issuance has only been over US$500 billion eight times and only over US$600 billion three times, the third of those being Q1 2021,” it noted. “Not to be ignored, UST issuance, long term only, continued in large numbers, to US$992.3 billion.” This was 110% of 2023’s average quarterly issuance and the single digit QoQ growth was off a “large base”, and despite being down from the US$1 trillion plus from Q3 2020- Q2 2022, has still delivered US$900 billion in four of the last seven quarters.

Although concerns have been rising about the power of the market to absorb this level of issuance, so far it has held. Primary activity has led to higher average daily trading volumes over Q1, with total average daily traded volume of US$1.3 trillion, up 11.7% QoQ, led by credit with US$55.5 billion ADV, but the additional activity on both primary and secondary can soak up time during the day for buy-side traders, reducing their capacity to increase engagement with secondary trading. Increased automation of primary markets cannot happen too fast and where electronic platforms are being adopted, they are proving popular with users.

©Markets Media Europe 2024

©Markets Media Europe 2025