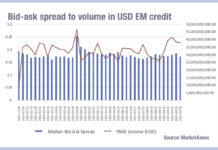

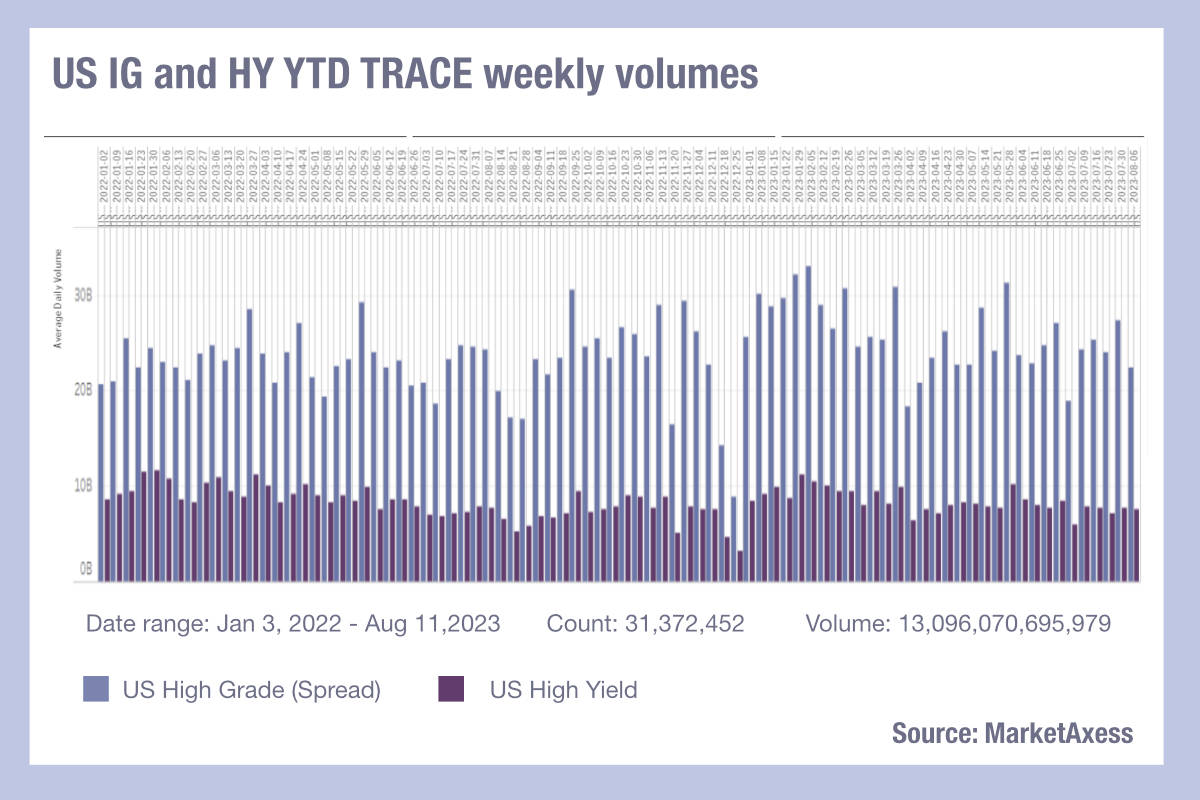

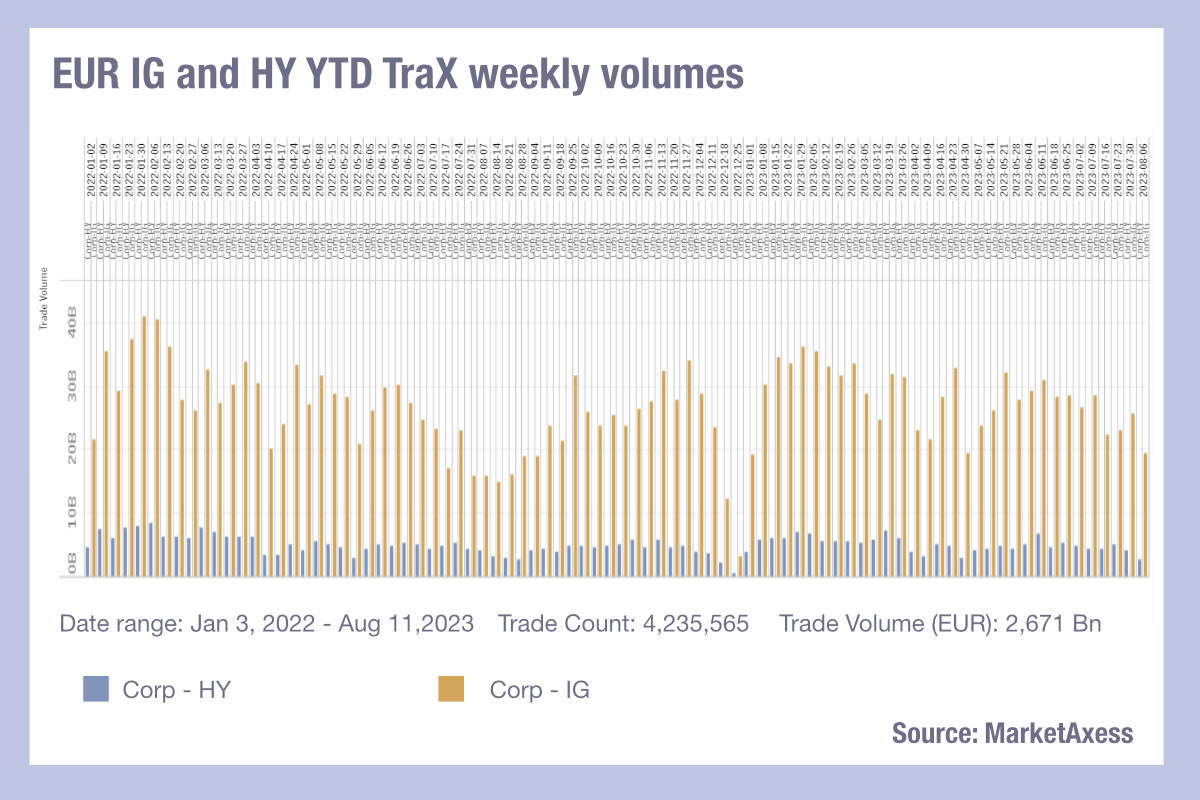

Secondary credit trading is seeing lower volumes as expected in the summer months, whilst bid-ask spreads have plateaued across Europe and the US markets, according to data from MarketAxess Trax, which tracks activity across different markets and platforms.

Although this can be taken as a net indicator of weaker liquidity, relatively speaking liquidity has been reportedly poor this year, and lower activity in a highly manual market limits the demand to monitor activity. In a very manual and fragmented trading environment, it is challenging but necessary for traders to keep an eye on the screen as closely as possible.

One platform might show a trade that others do not, and limited integration between different tools is a barrier to automating alerts for traders to help them track axes, indications of interest (IOIs), and request for quotes (RFQs). A very busy market therefore sucks up management time by the trading team. A quieter market gives the opportunity to review new trading protocols and tools.

Over the past year several new developments have come to light in the automation of trading, and the capacity to process greater amounts of information. Notable among these is the application of artificial intelligence (AI) based tools that can increase traders’ ability to search fragmented markets for bonds, and to build automation into the trading workflow.

Fixing the roof while it is metaphorically sunny will help trading desks to counter the job losses that have reduced buy-side trading capacity in the credit space.

©Markets Media Europe 2023

©Markets Media Europe 2025