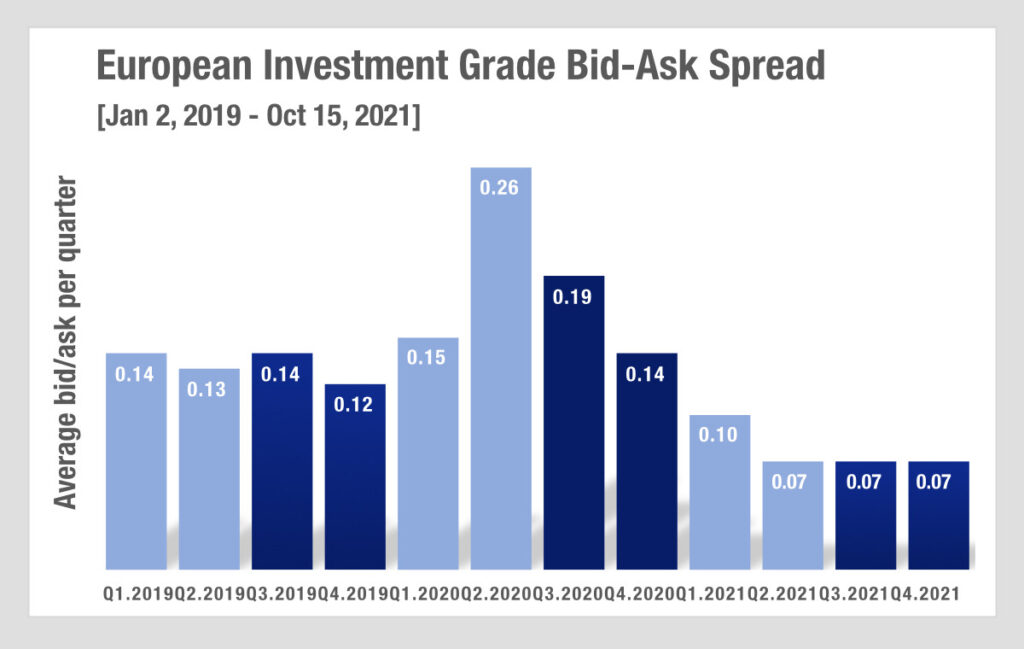

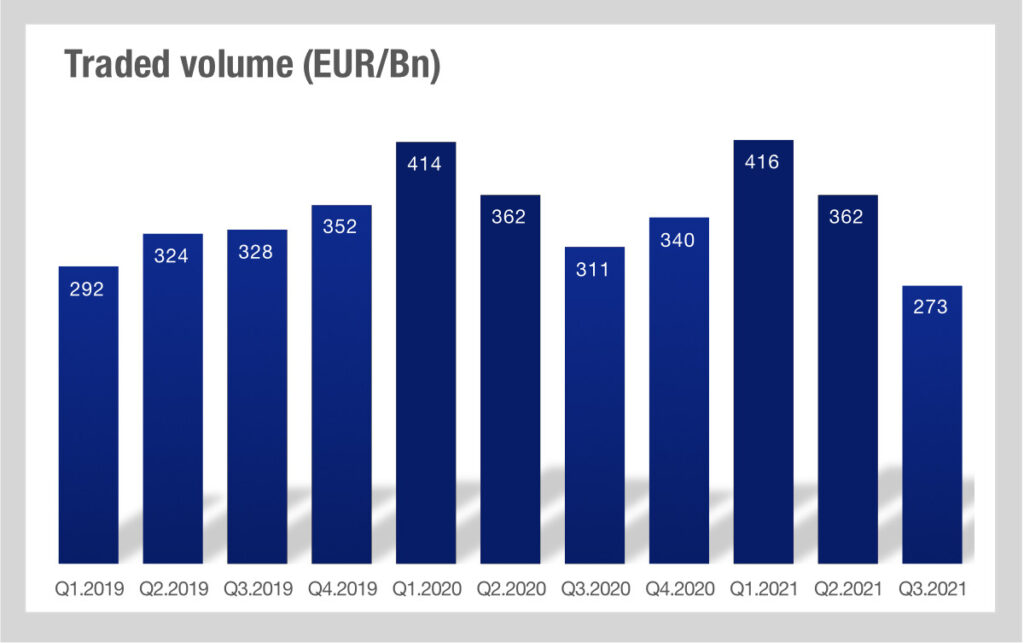

Secondary market data paints a picture of the challenges faced by sell-side market makers in the European corporate bond market during Q4. Information from MarketAxess indicates that the spreads and volumes in European credit were both down considerably on previous quarters, as well as year-on-year.

Secondary market data paints a picture of the challenges faced by sell-side market makers in the European corporate bond market during Q4. Information from MarketAxess indicates that the spreads and volumes in European credit were both down considerably on previous quarters, as well as year-on-year.

TRAX volume in the same time period has shown Q3 is down 13% vs Q3 2020 and down 17% vs Q3 2019 (pre-Covid).

Buy-side traders report that liquidity has not generally been hard to find in 2021. While they note the market has generally been grinding tighter this year in euro credit, barring the turbulence from a few macro market concerns which led to wobbles in the market, and despite the ongoing consumption of bonds by the European Central Bank (ECB), getting the right assets at the right price has not been too challenging.

By contrast the big investment banks have been reporting falling fixed income trading revenues of between 16% to 20% against the same quarter in 2021. While in 2020 sell-side bond desks had an outstanding first and second quarter due to the volatility created by the oil crisis and COVID Pandemic, 2021 has largely seen concerns around oil and gas, plus some concern about central bank tapering, but much calmer responses to the ongoing pandemic.

That has created limited opportunities for the dealers to push out spreads. Moreover the incursion by non-bank market makers largely into the smaller trade sizes has meant there is greater competition at the tighter end of the market, where larger numbers of smaller tickets were traded.

The data here show the value in understanding counterparties situations at a macro level, but also the longer term trends impacting the credit market today – Q4 is currently on trend to follow Q3.

©Markets Media Europe 2025