US markets regulator the Securities and Exchange Commission (SEC) has published a report to the US Congress on algorithmic trading in US debt and equity markets, referencing the considerable impact of algorithmic futures trading upon cash markets, without discussing joint supervision of both. That is despite a recommendation by the Financial Stability Oversight Council (FSOC), which is quoted in the paper.

The FSOC wrote in its 2019 annual report, “Regulators should also assess the complex linkages among markets, examine factors that could cause stress to propagate across markets, and consider potential ways to mitigate these risks.”

The importance of this interconnectivity is evident throughout the SEC’s own review of algo trading. The Chicago Mercantile Exchange (CME) is the centre of electronic trading for both equity futures and US Treasury market futures. In its report the SEC notes that, “the E-Mini S&P 500 Futures contract traded on the CME is often regarded as a central focal point for price formation in the equities market.”

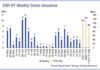

Futures trading on the CME is also a key driver of liquidity in the US Treasury market. A recent report published by analyst firm Greenwich Associates highlighted the importance of the basis trade between the cash bond and futures markets, which are roughly equal in size, in providing liquidity to market. The futures market was described as “the nexus of liquidity” for Treasuries by one analyst. The SEC report discusses futures trading in the context of disruptive market events and as pricing support for cash markets.

The US regulatory structure separates supervision of cash markets and derivatives markets between the SEC and the Commodity and Futures Trading Commission (CFTC), the latter supervising futures trading. Each regulator issues separate rules to address concerns in the market; one set for cash markets, the other for derivatives.

Following disruptive market events, such as the flash crashes of May 2010 (equities) and November 2014 (US Treasuries), the SEC and CFTC have had to work jointly to piece together the details across markets, the latter flash crash also including the Treasury and the Federal Reserve. In neither case was a clear source for the disruption found.

Trading activity on the CME has played a significant part in both events, according to the SEC, while the Bank of England also identified trading on the CME, and notably pauses in its trading, as potentially amplifying the sterling flash crash of October 2016.

The CME has itself been active in fighting disruptive trading, developing rules to counter malpractice. Since acquiring Nex Group in 2018 it has a view across the majority of US treasury trading in cash and futures – but no regulator does. Rules have not been jointly developed to address trading that impacts both cash and futures markets.

The SEC paper, entitled ‘Staff Report on Algorithmic Trading in US Capital Markets’, is a review required by Section 502 of the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018. The SEC notes in its conclusion that it has “undertaken various measures, and is evaluating other actions, to increase transparency, mitigate volatility, enhance stability and security and otherwise improve market integrity” as outlined in the report.

A report on automated trading in the futures market by the CFTC, published in 2015 and updated in 2017, omitted any reference to the 2014 flash crash, disruptive trading or potential risks from automated trading.

The SEC did not respond to a request for comment on the report.

©Markets Media Europe 2025