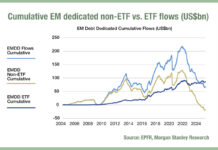

In often illiquid and volatile emerging markets (EM), achieving best execution is a vital part of delivering on fund objectives. Increasingly, electronic trading plays a critical role, helping the buy side and sell side access deep liquidity and market data at the click of a button – even for larger ticket sizes.

At a recent client panel, MarketAxess invited leading market participants from RBC BlueBay Asset Management, Aberdeen and Morgan Stanley to debate the key trends shaping the EM Hard Currency landscape. The discussion focused on the rising importance of technology infrastructure, new execution solutions and the growing utility of trade and performance data. Here we highlight some of the key topics and takeaways.

A dynamic EM Hard Currency landscape

EM Hard Currency trading is more dynamic, more sophisticated and more tech-driven than ever. Both on the buy side and the sell side, traders are embracing digitalized and tailored approaches to execution—choosing the right product to suit their trading needs. From Open Trading®, our all-to-all marketplace, to Targeted Request-for-Quote (TRFQ), our newly launched block trading solution, market participants are focused on developing a range of trading styles, with the buy side working to ensure dealers understand their execution, efficiency and data needs.

A common observation on our panel was that growth in EM trade volumes demands a more granular and targeted execution environment.

On the buy side, there is acknowledgment that protocol selection is a critical skill set, with traders seeking to strike a balance between obtaining the maximum amount of data and being equipped to cleanse and use it effectively. For instance, dealers may send quoted prices, but if those prices don’t hold at the time of the trade, they become meaningless. For that reason, dealers that consistently meet buy-side needs are likely to secure more frequent and larger transactions.

As EM trading volumes rise, automation promotes scalability and efficiency through the trading process. Traders on both the buy side and sell side point to its role in helping them manage a growing ticket count at a time when overall headcounts are falling. Moreover, it frees up time to execute larger trades, research the most appropriate solutions and select counterparties. And across different regions, electronic markets are helping traders access new, and often local, partners. That said, long-standing priorities such as excellent relationships, consistency and a strong ecosystem still apply. The challenge for traders is to effectively use a combination of approaches in parallel to optimize their trading strategies.

The benefits of TRFQ

Launched just a few months ago, panellists agreed that TRFQ is an increasingly valuable addition to the EM Hard Currency toolkit.

“We noticed that electronic trade sizes grew across markets, while EM Hard Currency was lagging behind and the process of choosing dealers for $3-8 million tickets was tricky,” said Dan Burke, Global Head of EM at MarketAxess. “In addition, we listened to the feedback of our dealers who told us they’d be more comfortable trading larger sizes electronically if they could operate in a more contained environment with more transparency on the number of competing dealers. All this signalled the need for a new approach, a new technology solution that would benefit both buy side and sell side and result in better execution outcomes all round.”

The TRFQ solution helps buy-side traders get better pricing for larger trades, sell-side traders get more comfortable trading those sizes electronically and it also helps match traders with the best available counterparties. Designed for trade sizes of more than $3 million, it solves the dealer selection pain point by suggesting up to eight sell side players that are axed or have recently been active in the relevant bond, allowing the trader to accurately define his or her selection.

Combining the benefits of voice with the efficiency of electronic trading, TRFQ is a fast route to best execution. “It really does work,” said one event attendee. “Both for EM Investment Grade and High Yield, the pre-trade dealer selection functionality is a valuable upside.” Hit ratios on TRFQ are about 13% higher than on the wider platform, showing that the matching functionality operates effectively in bringing willing counterparties together. Indeed, MarketAxess’ clients go on to invite 80% of TRFQ recommended dealers onto their tickets, indicating a big potential upside for dealers if they share their axes on the platform.

From the buy side’s perspective, TRFQ’s data-driven workflows are a significant benefit. Dealer selection takes in multiple factors, including live axes, best 30-day performance and market depth, enabling traders to make decisions based on a wide range of metrics for every trade.

Traders on the panel highlighted the benefits of the product’s data marshalling capabilities. “Any data we can leverage off, we do,” said Russell Beer, Senior Fixed Income Dealer, EM Debt at Aberdeen. “Knowing the volume on a bond or where people are axed is invaluable for us in our client discussions. And having an accurate mid-price with just one click is super key.”

From a dealer perspective, data benefits include a range of monthly statistics and, most importantly, the opportunity to join a narrow field once they are selected on any ticket.

The vital role of Open Trading

While TRFQ opens the door to larger e-traded ticket sizes, Open Trading still plays a vital role. Many market participants value the advantages of an unparalleled liquidity pool, sourced through more than 2,000 global institutions, and best execution through anonymous counterparties.

“From odd lots to small lots, the all-to-all protocol is becoming much more seamless than it was in the past, and it takes out the stress,” said Mark Harrison, Senior Trader, BlueBay Fixed Income, EM at RBC BlueBay Asset Management.

With average daily volumes reaching about $4 billion, buyside participants highlighted the benefits of being able to reach out to accounts they don’t have established lines with, offering both trading optionality and the potential to access new insights. “The Street is much more bought in than it was previously,” said Harrison. “That helps me discover counterparties that I wasn’t aware even traded the bonds.”

MarketAxess’ Burke concurs with that view. “For tickets under $2 million in EM Hard Currency corporates and tickets under $3 million in EM Hard Currency sovereigns, Open Trading brings incredible benefits,” he said. “The average price improvement on those smaller trades is 23 cents above the next best disclosed dealer. One of the reasons is the increasing number of diverse participants providing liquidity through the all-to-all network.”

On the sell side, Open Trading offers a unique ability to ensure that even the most esoteric bonds can find buyers. When executing Portfolio Trades, for example, the solution helps trading desks locate counterparties without needing to send out axes for small sizes. And through MarketAxess’ Dealer-initiated RFQ, the trader is able to both offload risk and find new opportunities in the market.

Dealer selection and performance analysis

The data-driven dealer selection that is critical to TRFQ is equally as valuable in other types of trades, with market participants increasingly looking to identify liquidity based on real performance metrics rather than reputation or habit. “If we can look at things such as hit rate data, we open the door to exploring new avenues and maybe giving someone else a try,” said Aberdeen’s Beer. “And if we do that and the dealer doesn’t disappoint, there is a high chance we will give them more business.”

Looking to the future, there is an opportunity for data analytics to add even more value. Panellists highlighted the potential utility of cost analysis for block trades and of lists of trades of certain sizes. They could then pass these on to clients with more confidence. On the other hand, there are situations where data could be more reliable. A common challenge is where dealers fail to regularly update axes. In that context, a useful innovation would be a feature to guide traders on the quality of axes, potentially supported through publication of hit ratios, win rates or slippage to pre-trade levels.

“It’s a data war out there,” said Aberdeen’s Beer. “People are clamouring for data, and good data helps us see who is most consistent, which helps us with planning for trading across the board.”

As market structures continue to evolve, panellists agreed that access to diverse trading and data solutions has become increasingly crucial. Whether it’s voice trading, e-trading, automation, portfolio trading, or the newly launched TRFQ, the key is finding the right tool to support seamless and efficient execution. At MarketAxess, we are dedicated to empowering our clients with a comprehensive toolkit and the flexibility they need to navigate the dynamic EM landscape.

This article was originally published on the MarketAxess website – LINK HERE

©Markets Media Europe 2025