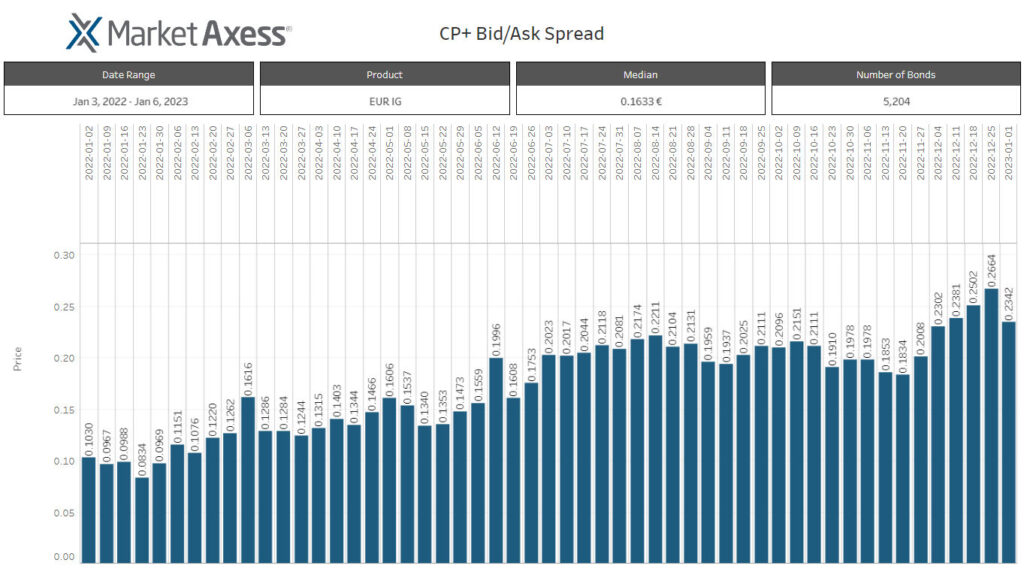

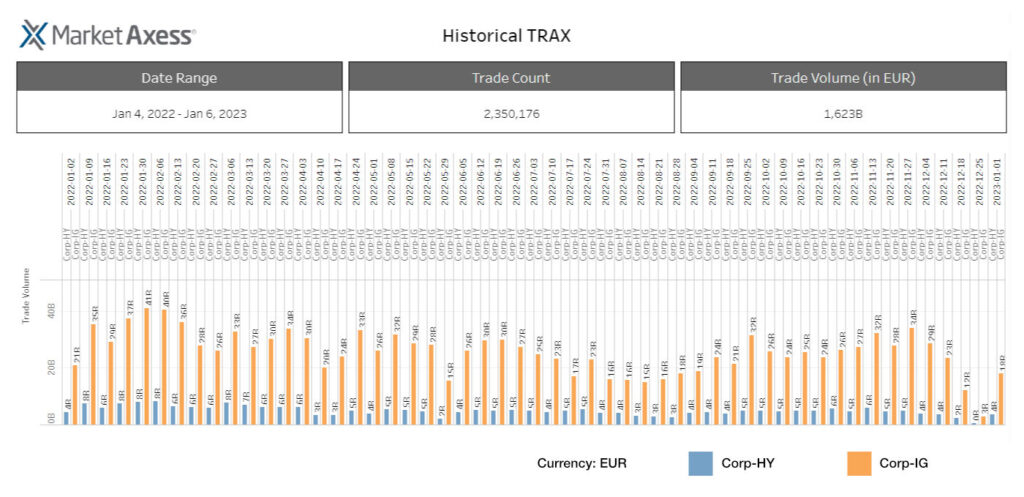

The new year has seen trading volumes drop back to a similar level as seen in early January 2022, but in European credit, bid-ask spreads are still elevated relative to last year according to data from MarketAxess Trax, which tracks trading across multiple markets and counterparties.

That suggests that secondary liquidity may be worse that in late 2022, where volumes were at least higher. TraX indicates that with fewer trades and wider bid-ask spreads, it may be harder to find a trade in addition to the explicit cost being raised, meaning the implicit cost of trading is also up.

A question hangs over the ability for banks – or other counterparties – to reduce the bid-ask spread this year, and the answer hinges on a few factors.

Firstly, if banks are able to trade more efficiently, they may be able to reduce the risk they are exposed to and therefore reduce the spread they are asking for certain ISINs. They are keen to promote direct streaming and clients are keen to adopts – up to a point.

If a streamed price is firm, that offers a real advantage to the client both pre-trade and potentially by engaging with the dealer. However, the market maker may consider that to be giving away information albeit to a single client. Systematically providing continuous individual prices to multiple clients is resource intensive.

On the other hand, if streamed prices are not firm they are little better than on-screen prices elsewhere. If a client tries to trade with a price that is not firm, they risk disclosing information to that dealer making the information leakage narrower than with an in-competition request-for-quote but no more useful.

Buy-side firms also need to feel confident they can justify best execution via a streamed direct price, and some do not feel that certainty yet.

Primary markets are potentially a boost to sell-side revenues this year despite the higher rates for borrowing, yet banks do not always share resource across functions, in this case debt capital market (DCM) revenues being separate to trading revenues, even if they share the goals of distributing securities to investors.

Finally, we will have to see how platforms draw the buy- and sell-side firms together in 2023. While both MarketAxess and Tradeweb are under pressure from investors to capture more revenue, there is still more growth in market share to be taken from voice and non-electronic trading, and a push by either to encourage sell-side use would potentially increase dealer activity.

©Markets Media Europe, 2023

©Markets Media Europe 2025