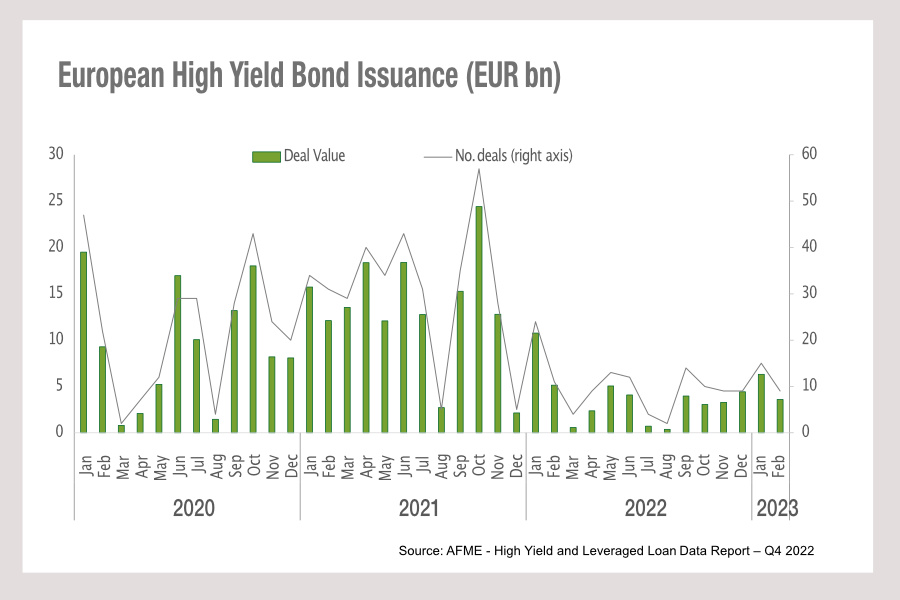

Despite some optimistic outlooks on bond issuance in 2023, high yield bonds are clearly seeing a decline in Europe, based on data from the Association of Financial Markets in Europe (AFME).

Despite some optimistic outlooks on bond issuance in 2023, high yield bonds are clearly seeing a decline in Europe, based on data from the Association of Financial Markets in Europe (AFME).

It shows that primary high yield bond issuance in Q$ 2022 increased 114.2% quarter-on-quarter, but decreased 72.7% year-on-year. The quarterly issued amount stood at €10.7 billion, more than double the amount issued in Q3 2022 (€5 billion), but only a quarter of the amount issued in Q4 2021(€39.8billion).

As the start of the year typically reflects the greatest period of bond issuance, this suggests that issuance will potentially drop off for high yield investors more significantly in 2023 than in recent years.

That will create a challenge for investment funds seeking to use HY bonds in their portfolios. Firstly, as supply reduces, the need to trade in the secondary market will increase adding competitive pressure to trading desks.

Understanding the liquidity picture pre-trade will become more important and any capacity to price and trade large amounts of asset rapidly, as opposed to piecemeal order filling, could be a real advantage for the desk. Trading non-cash bond to get shorter term access to liquidity via future s and exchange traded funds may prove one useful route.

Equally where bonds are being issued, the coupons on the new bonds will be significantly higher due to rising rates, leading to heightened demand for these assets.

Without the frequent pricing points of new issues to provide a consensus, issuers, syndicates and investors may see a wider range within which new bonds are priced, leading to harder negotiations during the issuance.

Buy-side traders could find they can add more value in these circumstances, and that is a net positive for the trading desks, although the limited resourcing available to support them will it a challenging year ahead.

©Markets Media Europe 2023

©Markets Media Europe 2025