There have been an enormous number of factors shaking up bond trading this year. From fixed income fundamentals like rapidly rising interest rates from a low base, to a war in Eastern Europe, to massive underfunded government tax cuts and spending in the UK.

This has ongoing stress has exposed two types of weaknesses in bond market liquidity. The first of these has been structural problems as see in UK gilts. The second has been a further withdrawing of liquidity provision by dealers.

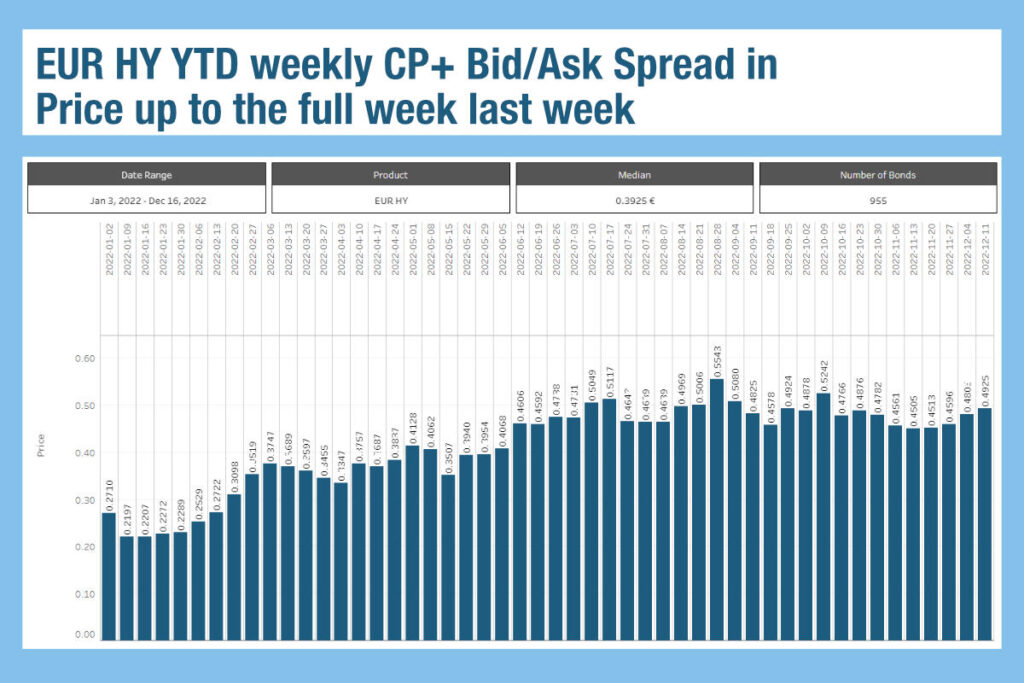

While this has been reflected at the extreme by bidless markets, it is also apparent in the cost of liquidity.

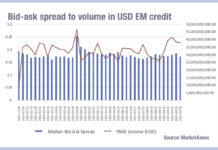

Source: MarketAxess TraX

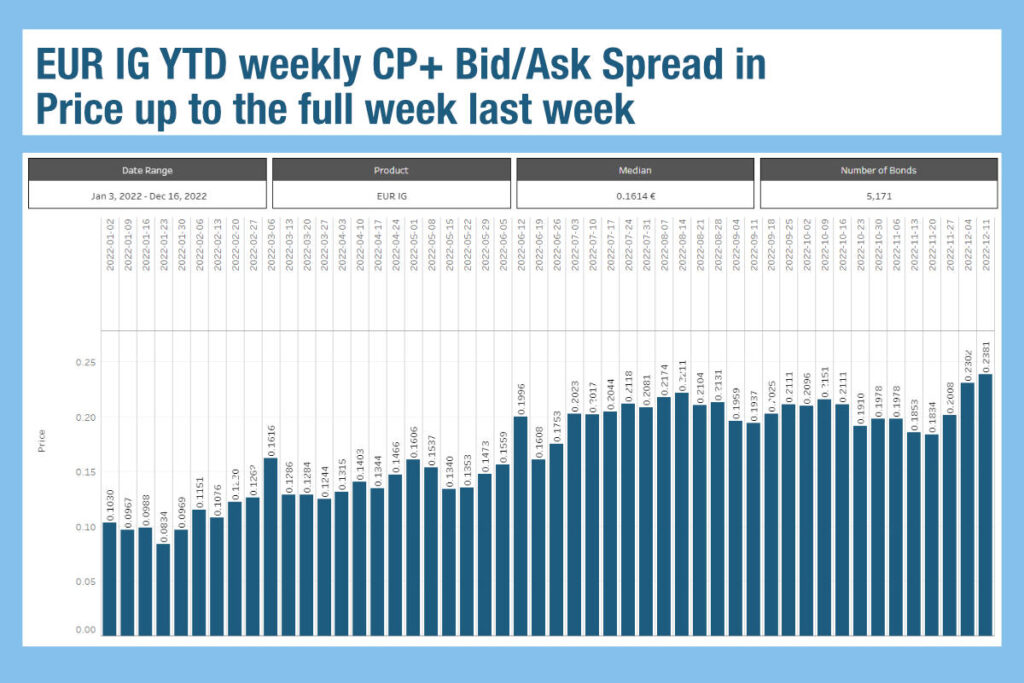

Looking at data from MarketAxess Trax, which tracks trading across multiple markets and counterparties, we can see that in the full year for 2022, the average bid-ask spread for investment grade trading has doubled, from €0.103 for the week of 2 January 2022 to hit €0.2381 in the week of 11 December 2022.

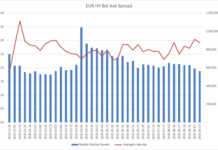

Source: MarketAxess TraX

Average bid-ask spreads in high yield trading across Europe has increased by 1.8x over the same period. These bid ask spreads are indictive of the costs being applied by dealers to take risk even over very short periods, or for riskless principal/agency trades. For the buy-side trading desk this creates a real challenge as tighter budgets restrict the capacity of desks to increase trading efficiency.

In 2023, it will be a goal for dealers to increase margins following poor profits in H2 for secondary trading.

The question will be, how can buy-side traders respond? They want their counterparts to engage more fully with market-making, but need costs to be matched by support in stressed conditions.

Direct trading from streamed prices is one possible way of engaging. It seems likely that – as with portfolio trading in 2020 – its success will be determined by inclement market conditions, and there is the potential for a substantial hike in use should those conditions occur.

There may also be ongoing active engagement with non-dealer liquidity sources – electronic liquidity providers and all-to-all trading – which can reduce costs of trading and create more direct access to natural liquidity. On that basis, 2022 could make or break models for trading in European credit.

©Markets Media Europe 2025