Electronic trading platforms saw a big boost to trading volumes in December, finishing off a great year for fixed income.

Tradeweb

Tradeweb Markets has reported a total trading volume for the month of December 2023 of US$28.9 trillion. Average daily volume (ADV) for the month was US$1.46 trillion, an increase of 43.3 % year-over-year (YoY).

For Q4 2023, total trading volume was US$104.4 trillion and ADV was US$1.68 trillion, an increase of 56.9% YoY.

Billy Hult, Tradeweb CEO, said, “Historic interest rate moves, geopolitical uncertainty and ongoing market volatility helped drive a 2023 resurgence in fixed income. Despite a challenging start to the year, we reported a 27.6% YoY increase in average daily volume for the full year and broke numerous volume records across rates, credit, equities and money markets. The fourth quarter was particularly strong in rates, and in December we reported a record 18.2% share of fully electronic US High Grade TRACE for the month.”

In December, Tradeweb’s US government bond ADV was up 39.8% YoY to US$159.5 billion, supported by growth across all clients sectors, increased adoption across a diverse set of trading protocols on the institutional platform and sustained rates market volatility, Tradeweb said.

European government bond ADV was up 21.5% YoY in December to US$33.4 billion, driven by sustained rates, market volatility and strong hedge fund activity.

Fully electronic US credit ADV was up 56.4% YoY in December 2023,to US$5.6 billion and European credit ADV was up 26.2% YoY to US$1.6 billion. “Strong” US credit volumes were driven by increased client adoption of Tradeweb protocols, the firm said, most notably in request-for-quote (RFQ), portfolio trading and Tradeweb AllTrade.

In the same month, European credit volumes were supported by strong activity in portfolio trading and Tradeweb Automated Intelligent Execution (AiEX), as well as increased client adoption of the firm’s smart dealer selection tools and Tradeweb AllTrade protocols. Overall, global portfolio trading ADV was up 87% YoY.

Municipal bonds ADV was down 5.3% YoY in December to US$414 million. While outpacing the -14% drop in the broader market, Tradeweb said, municipal trading volume slowed marginally, as retail investors digested lower yields and institutional tax-loss harvesting activity waned.

Credit derivatives ADV was down 4.9% YoY in December to US$7.5 billion in December 2023, with tight credit spreads and low market volatility leading to slightly lower overall swap execution facility (SEF) market activity.

MarketAxess

MarketAxess saw its monthly high grade credit volumes for December 2023 jump 21% YoY, with Eurobonds witnessing a similar increase at 17% YoY. However, total rates dropped 11% YoY in December.

Chris Concannon, CEO of MarketAxess, said, “In the fourth quarter of 2023, total credit ADV increased approximately 9% compared to the prior year and increased 18% from 3Q23 levels, which benefited from record portfolio trading and record municipal bond trading volume. Client engagement with MarketAxess X-Pro, our unique proprietary data products and our automated solutions continues to build, and we believe that the strong market volumes in 4Q23 reflect an improving market backdrop as we begin 2024.”

Total ADV for December 2023 stood at US$27 billion, a 1% decrease YoY. Total credit volumes for the month of December 2023 stood at US$12.3 billion, a 16% jump YoY.

High grade credit stood at US$6.1 billion, a 21% increase YoY, while high-yield saw a 9% drop YoY, from US$1.6 billion to US$1.4 billion.

For emerging markets, volumes jumped 23% YoY, from US$2.1 billion to US$2.7 billion.

Munis saw a modest increase, with a 1% increase YoY, from US$473 million to US$480 million.

Total rates saw a 11% decrease YoY in December, dropping from US$16.6 billion to US$14.8 billion. US government bonds also dropped 11% YoY in December, from US$ 16.2 billion to US$14.3 billion.

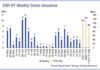

CME Group

CME Group ADV for US Treasuries in December 2023 stood at US$91.3 billion, an 8% increase YoY, up from US$84.7 billion in December 2022.

ADV US repos in December 2023 was up 17% YoY, from US$267.9 billion to US$3.3.5 billion. EU repos were down 17% YoY in December 2023, dropping from US$323.1 billion to US$267 billion.

For rates, CME Group saw a 44% increase YoY in monthly ADV for December 2023, from 7.9 million contracts to 11.4 million contracts, a record for the firm.

US Treasury futures and options ADV increased 44% YoY to 5.8 million contracts while options ADV increased 36% to a December record of 5.1 million contracts.

Interest Rate options ADV increased 36% to 2.9 million contracts while FX ADV increased 10% to a record 1.1 million contracts.

© Markets Media Europe 2023

©Markets Media Europe 2025