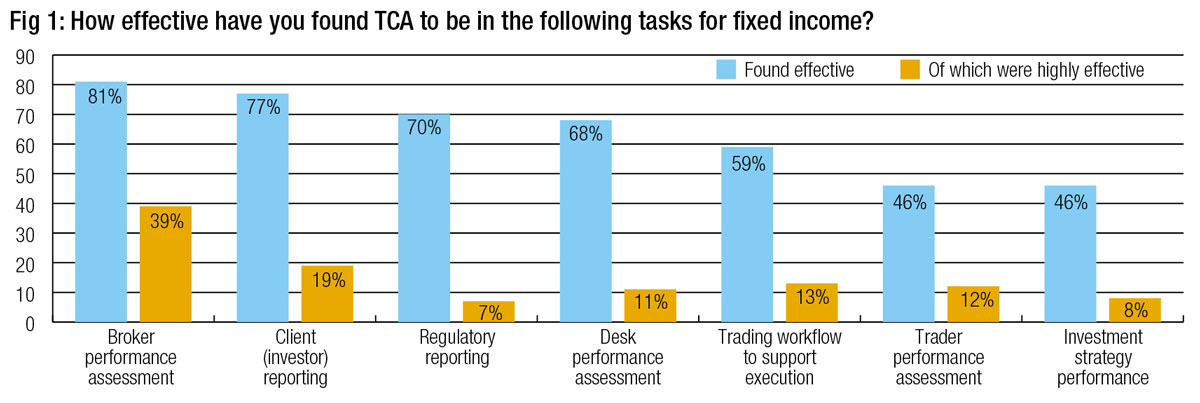

New research of 36 buy-side firms has found that 81% of respondents find fixed income TCA effective for assessing broker performance, 77% for regulatory and 70% for client reporting, followed by internal assessment measures. At the top of these is trading desk performance measurement (68% find it effective) then use in the trading workflow, for which 59% find it effective. Less than half (46%) find it effective at measuring trader performance and investment strategy performance, but that is still a significant minority.

When the same survey was conducted in 2021, analytics were proving useful for traders who used them as part of the execution process, but they were frequently not in the trading workflow.

Since then, their use in this task has increased – with effectiveness remaining rated at the same level of 59%, with 64% of respondents now using it up from 37% in 2021. This makes their use in the trading workflow the second most common application. Over the same period, the proportion using analytics to assess individual trader performance – a task for which trading analytics has consistently been seen as ineffective – fell from 37% to 28%.

Applying quantitative analysis to broker performance has consistently been the most popular use case, with desk performance on a par last year only, and that sits well with the use case for TCA in the equity space where execution quality is assessed according to given metrics.

Although its use for desk assessment has declined relative to last year, that is still the third largest use case for analytics in 2023, followed by its application in reporting both in a regulatory level and for clients.

©Markets Media Europe 2023

©Markets Media Europe 2025