Analysis by broker Redburn has found that major exchanges – in which it included MarketAxess, the fixed income trading venue, and interdealer broker TP ICAP – have a largely positive outlook based on multiple revenue streams and trading volume growth, with firms engaged in mergers and acquisitions seeing strong potential upside.

In its paper, ‘Exchanges: The Gatekeepers’, written by a team headed by analyst Nicholas Watt, market operators in the US and Europe were rated as either ‘neutral’ or ‘buy’ based upon their potential for growth across multiple business lines.

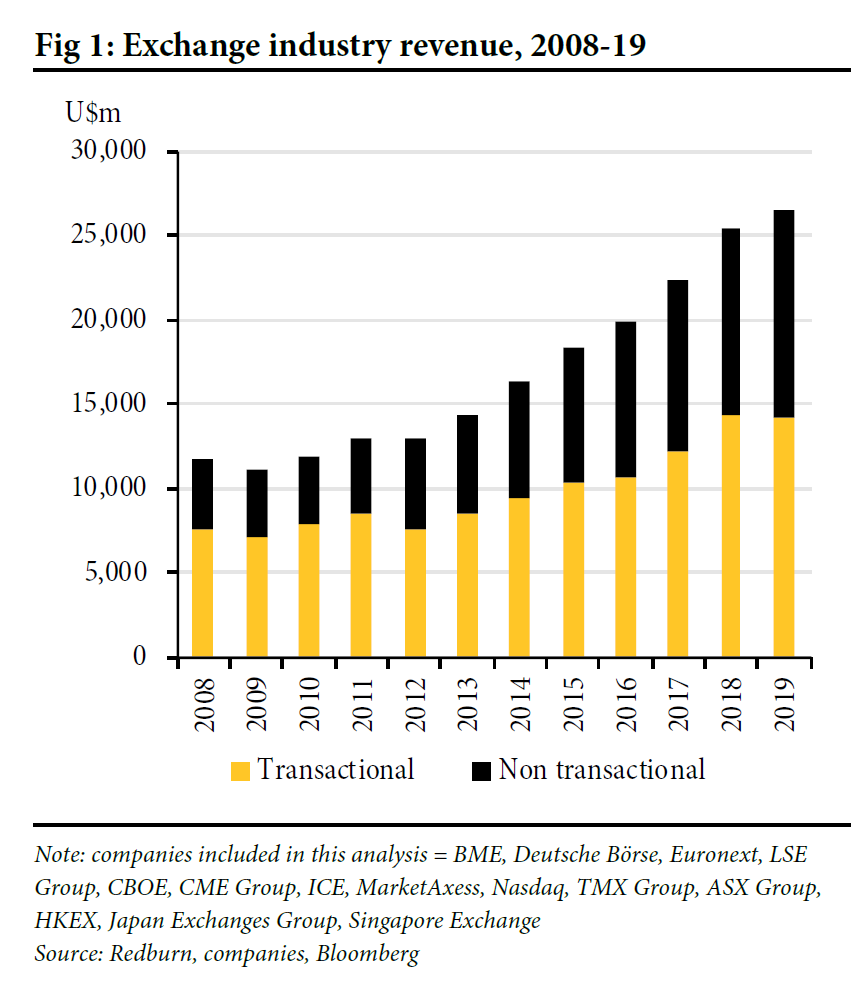

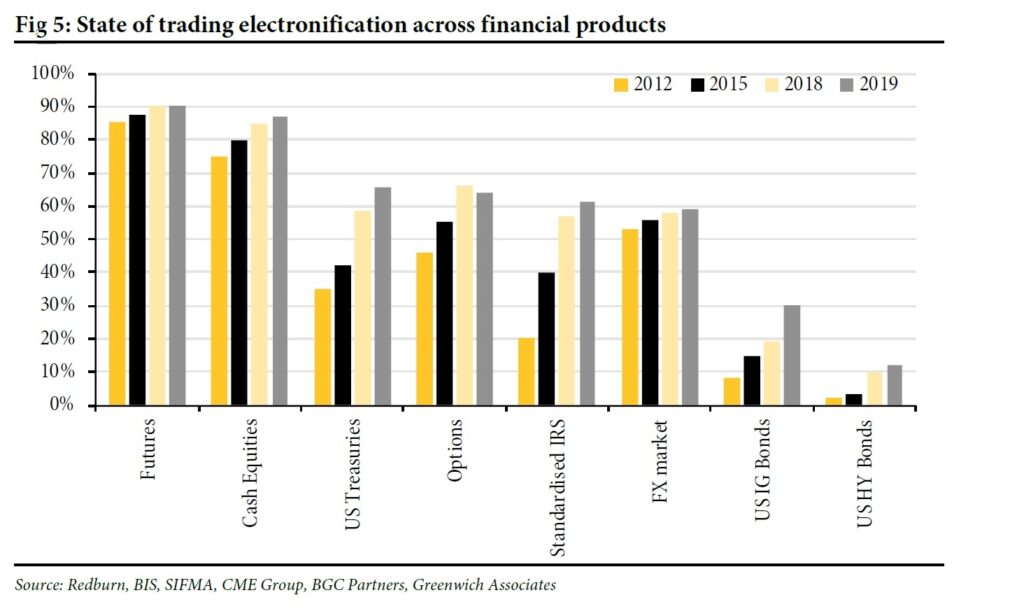

The report looks across the fixed income and equity markets, including derivatives, the brokerage found that future volume growth looks healthy while half the revenue for financial information and data will be accruing to exchanges by 2021, with “robust future growth expected given data trends,” wrote Watt.

The team noted that the opportunity to extend the use of electronic and data capabilities into middle- and back office functions is also growing.

“Capital market volumes in aggregate continue to deliver growth, given the effects of central bank activity, it is likely to be more volatile than in the past, with longer periods of lower than average volumes and bursts of extremely high volumes; 2020 has potentially provided a prototype of this environment, with elevated activity in H1 2020 giving way to a quieter H2,” wrote Watt. “Given the markets’ tendency to fret about the volume outlook for a highly rated sector during a period of more muted volatility and activity, this often provides interesting entry points.”

MarketAxess was rated as ‘neutral’ despite the level of client activity during the March sell-off which Watt noted “underscored the robustness of the model and alleviated one of our concerns, namely how it would perform in a severe credit stress event.”

Its greatest challenge, according to the analysts is the growing competition in corporate bond trading markets, which has intensified with Bloomberg’s recent announcement of a revised pricing model to support its product research and development.

London Stock Exchange Group, which is in the process of acquiring data giant Refinitiv and thereby a controlling stake in bond trading market operator Tradeweb, was rated ‘buy’. The pending acquisition of Refinitiv “redefines LSE’s investment case” wrote Watt, as the deal would see more than 70% of the group’s revenue being generated by information services, making it the second largest player globally, in addition to strength in equity, fixed income and post-trade services.

The analysts went against market sentiment on TP ICAP giving it a ‘buy’ rating, as they saw the firm’s acquisition of block trading specialist Liquidnet as positive.

“The recently announced acquisition of Liquidnet, an electronic trading platform principally focused on equity markets, has been met with an adverse market reaction,” wrote Watt. “We disagree with the market’s negative reaction to the Liquidnet transaction. It provides TP-ICAP with an electronic platform that, while primarily focused on equities dark pool trading, has the network and connectivity for TP-ICAP to develop competitive capability in the corporate credit and rates electronic trading markets.”

©Markets Media Europe 2025