Portfolio trading made up 11.4% of TRACE volume in December, and was up more than two percentage points year-on-year across the market.

The upward trajectory started strong in 2024, according to Ted Husveth, managing director of US credit at Tradeweb, who sees December’s record as the natural progression of the year’s results. “We were at about 7 or 8% of overall TRACE volume in 2023. There was a nice move upwards in 2024, and that move really started in January.”

An increasing number of clients are including portfolio trading in their day-to-day operations, Husveth observes. “Request-for-quote remains the main way that electronic trading is done, but most of our clients are becoming more thoughtful and advancing the way that they decide what they trade as a portfolio versus what they trade as a list.”

“You can get a large trade done this way and get it done that day. However, as the electronic solution has gone mainstream, new adopters have been increasingly using portfolio trading for trades both large and small – with the certainty of execution being the biggest draw.”

As the protocol’s popularity grows, dealers are improving their pricing algorithms and ability to recycle risk, Husveth explained. On the buy side, clients are investing inflows and outflows and using the strategy to make changes to their portfolios, such as extending duration.

Systemic funds are also engaging with portfolio trading, Husveth observes. “There’s a benefit of getting everything done at once. They might be buying some credits and selling some others in a kind of two-way portfolio trade. If they can get pricing and get that done in one go, it’s a huge benefit to a fund with that sort of strategy.”

Investment grade (IG) portfolio trading has far outpaced that of high yield (HY) historically, with the former hitting 900 billion trades in 2024 – equating to 14% of IG TRACE volumes. Due to tougher liquidity and harder pricing. HY portfolio trading has had a less steady journey – but that is beginning to change, Husveth explains. “HY really picked up towards the second half of the year, it’s started to follow IG. [Growth is] about the asset class, the liquidity, the ability for the dealers to be ready to price it, and the clients’ comfortability with the protocol. We’re hopeful that the trend HY is following continues.”

Electronification is a crucial element of the bond market, and portfolio trading is a key part of that. “It’s a meaningful driver. The overall growth in TRACE volumes that we’ve seen over the last few years has grown and some of that’s to do with new issues. But I think some of that has to do with portfolio trading being an entry point to liquidity,” Husveth says. “Underpinning some of the gross growth in TRACE is the fact that these trades are happening. It’s fuelling the dealer-to-dealer market and the dealer-to-client market on the back of these trades.”

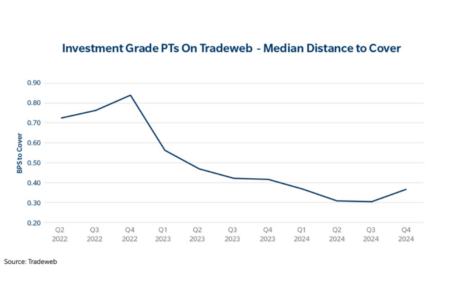

Also boosting engagement is a reduction in price. “The bid-offer spread compression shows that more of these trades are, on average, getting closer to our midpoints. The liquidity in the space is reducing the cost,” Husveth explains.

In 2024, the median distance to cover (the difference between the winning quote and the next best quote) dropped to record lows at Tradeweb. This illustrates greater transparency in basket pricing, increased market competition and enhanced execution quality, the company said, noting that many dealers in the space are seeing similar figures.

Tradeweb offers a number of portfolio trading solutions, including Net Spotting in the investment grade space and the ability to bulk cross bonds. “Let’s say you trade 1,000 item portfolio trades and you want to cross Treasuries, instead of generating 1,000 Treasury trades to hedge that trade we will bulk them up and create a maximum of seven trades – one for each Treasury. That’s been very popular in reducing ticket costs and creating efficiency,” reports Husveth.

“As time goes on, more efficiencies are being put into place,” Husveth concluded. “Some of those will involve better mechanisms on our side to match off liquidity between buyers and sellers. I’m expecting there to be further innovation in the space.”

©Markets Media Europe 2025