Platforms keen to emphasise longer term commitment to electronification and greater automation.

Multiple platforms have been launched to drive increased efficiency in managing bond issuance, with momentum building as issuance – and operational pressure – hit record levels.

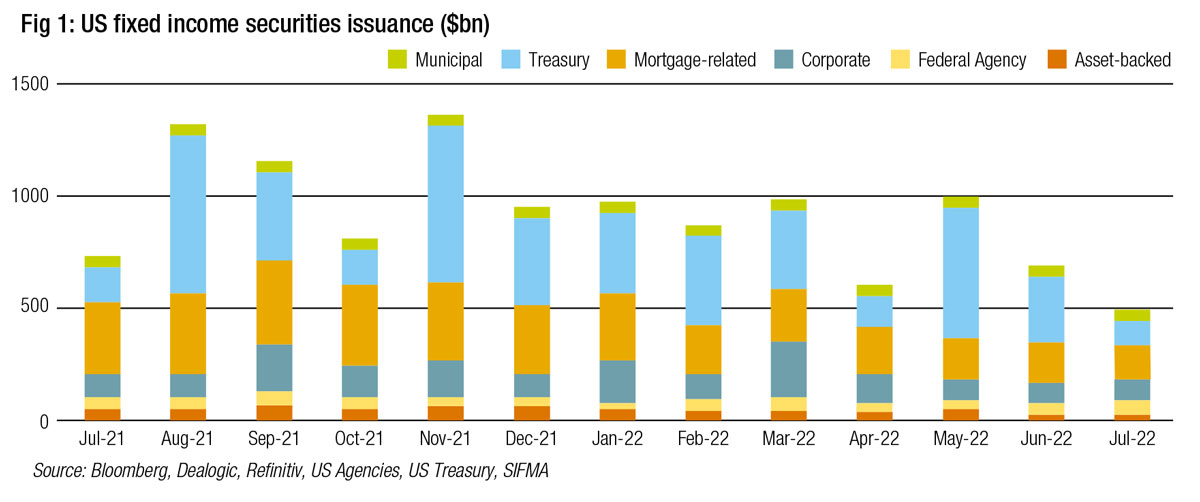

Now in 2022, bond issuance is falling as interest rates rise in response to increasing inflation, and increasing borrowing costs. In the US, where issuance is tracked by the Securities Industry and Financial Markets Association (SIFMA), monthly issuance in July 2022 was at its lowest level in the last 12 months (Fig 1).

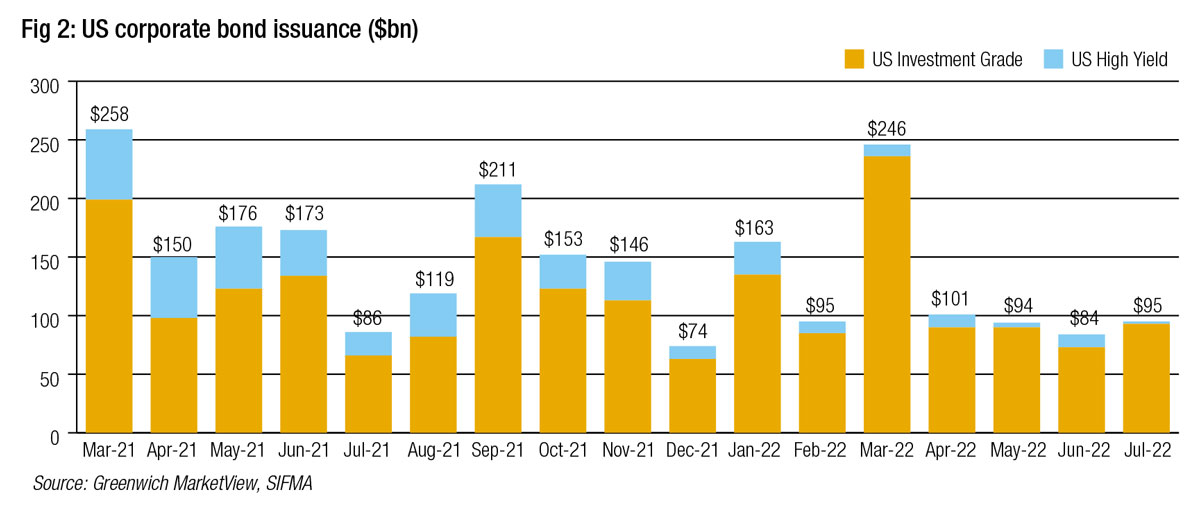

In the corporate bond space, although overall issuance in July was higher than in either of the previous two months, high yield bonds made up just 1.86% of that month’s new issues, where they were 13.6% of credit issued in July 2021 (Fig 2).

“Volumes are down,” agrees Charlie Berman, CEO of Agora. “Those are the moments when people need to think about how to make the underlying processes more efficient. If some people are saying ‘Maybe we can’t afford to do this’ there will be others saying, ‘We really can’t afford not to, because if our revenues are going down, we’ve got to do something about our costs.”

However, at the same time, long term structural secondary market activity has become more challenging for buy-side traders, and more profitable for sell-side traders, with bid-ask spreads blowing out and volumes falling.

This has been reflected in sell-side earnings. For example, in its second quarter earnings call with analysts, JP Morgan noted its underwriting fees were down 53% for debt while markets revenue was up 15% year-on-year in both fixed income and equities, despite Q2 being a strong quarter in 2021. Goldman Sachs also found that debt underwriting revenues fell 52% year-on-year in H2 2022, while fixed income, currency and commodities trading revenues were up 55% over the same period.

Resources may be harder to allocate to a function that is less likely to see growth over the next 12-18 months.

Carl Daucher, head of product, core applications and insights at Bloomberg believes the investment in primary market improvements represents part of a wider investment strategy which is unlikely to be derailed by current activity because it already has momentum.

“Number one, issuance has slowed down, it hasn’t stopped and it will pick up again,” he says. “Number two, we have talked about making data available faster, post-announcement of a new issue. We’ve seen uptake on that offering. We’ve seen a firm start pulling and consuming data from us earlier than clients were previously. There’s a lot of conversations happening about how best to integrate that with their existing security setup process.”

Firm commitment

Despite the slowdown in primary trading, the impetus to reform bond issuance is still high, say platform providers.

Rich Kerschner, CEO of DirectBooks, an issuance platform which is supported by a consortium of banks, says, “We don’t see any slowdown in the demand or commitment from the DirectBooks community for continued progress and we are certainly not slowing down.”

Daucher says, “Bloomberg will continue to invest in this space. We see a long runway of benefits from this investment for our clients extending beyond corporate investment grade and high yield new issues, to other security segments within fixed income. From a technology and network efficiency perspective the investments we’re going to make are to accelerate data availability, so we’ll start here, and continue to move out on new issues across more security segments.”

This momentum is helped by the advantages that firms are realising through a more structured and systematic approach to managing primary market investments.

“Structural changes within firms set the agenda,” says Mark Taylor, head of fixed income product & business development at Liquidnet, which launched its primary market service in September 2021. “We’re talking to a large UK insurance company that at board level has set a mandate for all the orders in new issues to be processed, documented electronically, and to be trackable. They need a straight-through-processing solution and were aware that wasn’t going to arrive straightaway, and so it was the impetus for them to work with us, based on the OMS connectivity we provide.”

This is apparent within sell-side firms as well as buy-side firms notes Berman, due to the economic pressures.

“One of the reasons people adopt technology on the primary market side is that right across the value chain, they are constantly being asked to do more with less,” he observes. “There are very few syndicate or DCM desks anywhere in the world which are getting more people. That’s against a backdrop of increased scrutiny and regulation of pre and post trade activities and processes. Smart firms are all interested in making those processes more secure and less prone to errors. We’ve spent a lot of our time on that pre-trade process, where assets are actually contemplated and then created, and how we can make those processes more efficient.”

A better way forward

With such positive activity across both sides of the market, and with clear commercial pressures bearing upon the firms involved, those seeking to drive the evolution of bond issuance are positive about the prospects for continued forward motion.

Berman says, “Most sell-side firms I’ve worked with, when engaged in a new issue, hold a reserve as a percentage on their fees to cover errors and problems on settlement. If you ask how much of that reserve was typically used, I’d say, the reserve was at that figure because typically by year end we had used it all, because those are real costs when trades fail, or there’s been an error input. The costs are normally significantly higher than you would think. Anything that removes the risk of those problems is a good thing.”

There are even structural changes occurring within firms which emphasise the challenges they face, which would be relieved by greater issuance of securities.

Jonathan Gray, head of Liquidnet Primary Markets, EMEA, says, “We’re seeing the trend, certainly in larger asset managers, to have separate desks which handle a primary issuance and set the workflow around it. So instead of having PM, execution desk, all in that chain together which leads the trading desk to get involved in the manual processing of orders into new issues and getting allocations back and then booking them, there are now segregated desks and functions within the asset managers that handle all new issue flow. It is inefficient for somebody whose role is really running secondary trading, to spend half their day on the primary process.”

©Markets Media Europe 2025