Trading numbers in secondary corporate bond markets appear to reflect anecdotal reports of volatility bursts, as political false starts impact the reading of major economic indicators.

Traders are noting that volatility at the start of 2025 is in itself volatile, and while fixed income volatility indices are not displaying the level of elevation seen in equity volatility indices, based on the pricing of bonds, other data around trading of bonds is more supportive.

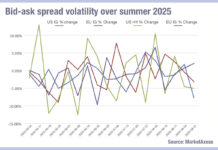

Looking at MarketAxess data across its CP+ price feed, and its TraX database, which follows activity across multiple markets, it is apparent that median bid-ask spreads in the US are bouncing around from one week to the next in investment grade and high yield corporate bond markets.

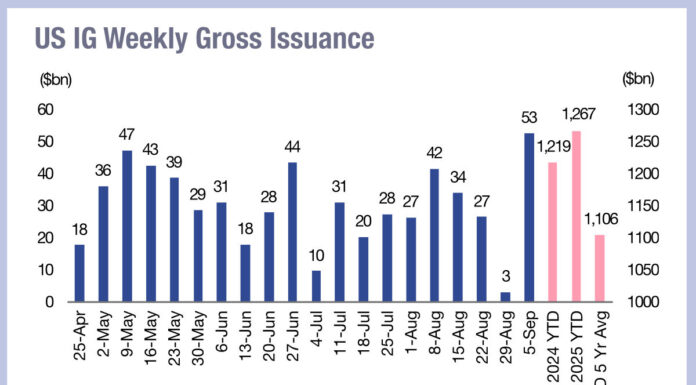

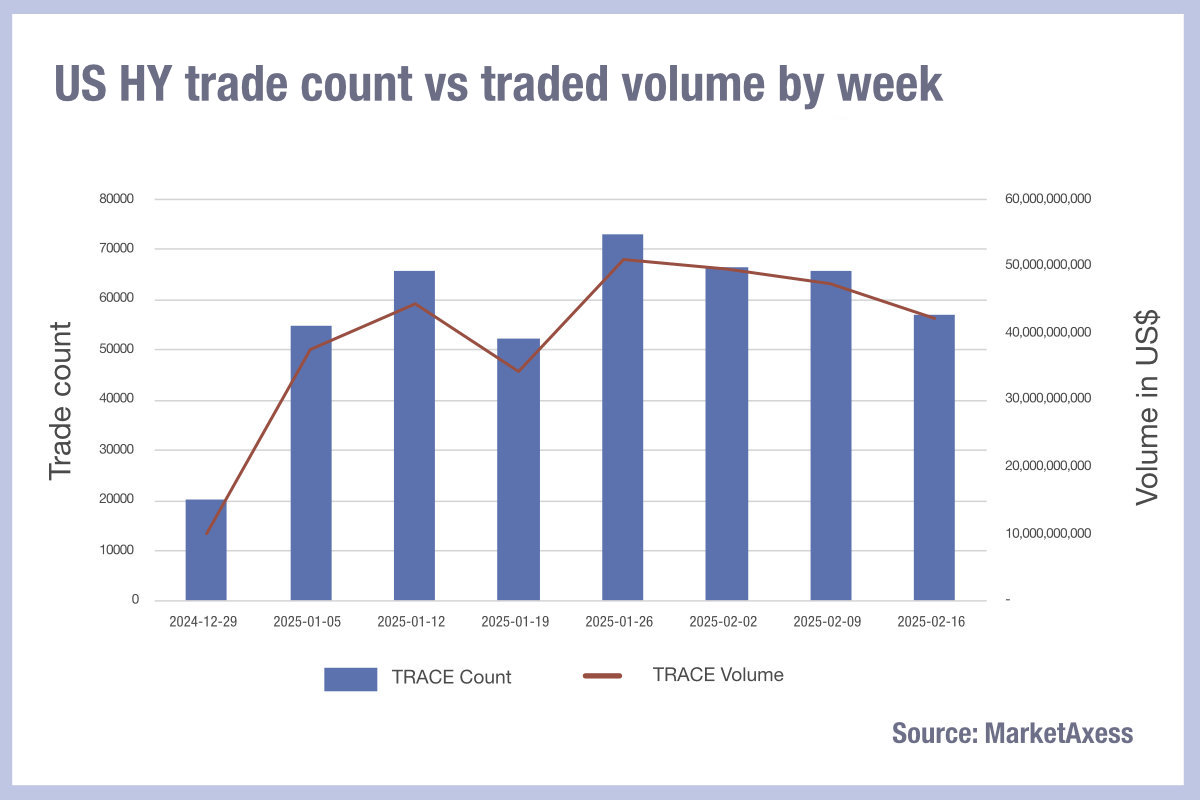

Average trade sizes have also plateaued, with the initial decline in average trade sizes starting to reverse at the beginning of February. With TRACE volume and trade count beginning to decline at that point.

A couple of possibilities exist here. Firstly, the average bid-ask spread for US IG is range bound at the lower end of market-makers’ margins. It may be that making a push from 0.085 to 0.08 as a % of par is too great a step for dealer margins, despite intense competition.

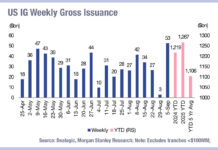

The flattening-to-dip in trading activity, despite peaking bond issuance which typically means greater secondary trading, may suggest there is a lack of investor confidence, or a reduction in dealer market-making activity, in secondary trading.

The latter would also correlate with the bouncing around of bid-ask spreads, as pricing liquidity becomes less certain on a week-by-week basis.

With tariffs now beginning to bite and a complete reversal in US policy across some areas of trade and geopolitics, perceived risk would appear to be increasing, making buy- and sell-side very cautious.

©Markets Media Europe 2025